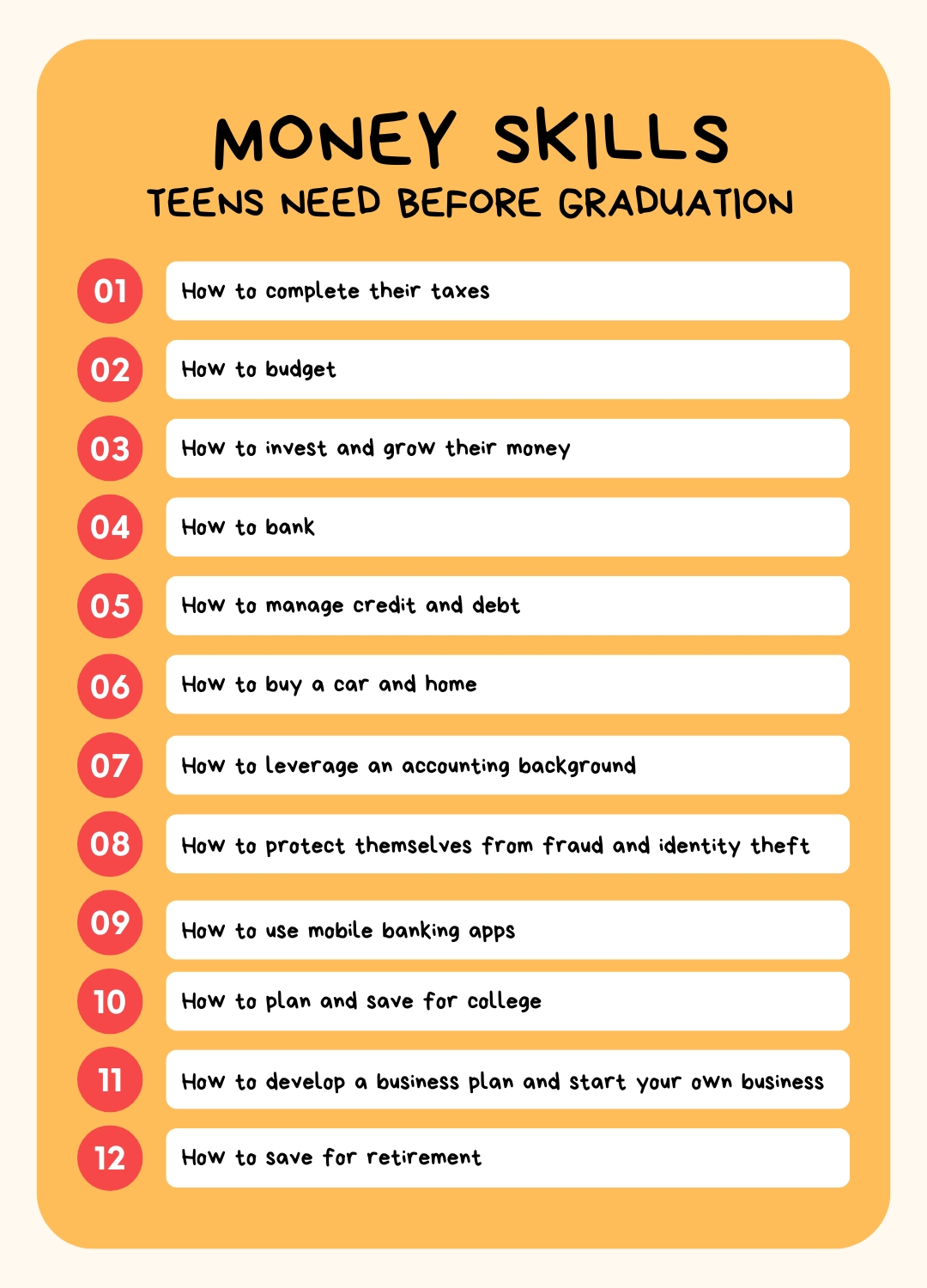

Do you know some teens who could use a crash study course in “adulting”? We hear you. Budgeting and preserving are not on all of our students’ radars, but they are competencies college students will need to have no issue what their futures hold. Whether or not you’re planning a comprehensive economical literacy semester or just advising a college student in require, listed here are 12 money competencies teenagers require in advance of graduation. To support you with this, verify out these interactive lessons to complement your present math and economics curriculum, readily available for no cost from our pals at EVERFI. For the reason that it’s hardly ever also early to develop a basis for money literacy.

1. How to entire their taxes

A person sobering fact that comes with adulting is obtaining to fork out taxes. So being familiar with how to determine and spending plan for taxes is an vital skill. With instruction and exercise, teens can enter the workforce emotion self-confident and empowered.

Test this: EVERFI Money Literacy for Superior University, Lesson 2: Cash flow and Employment

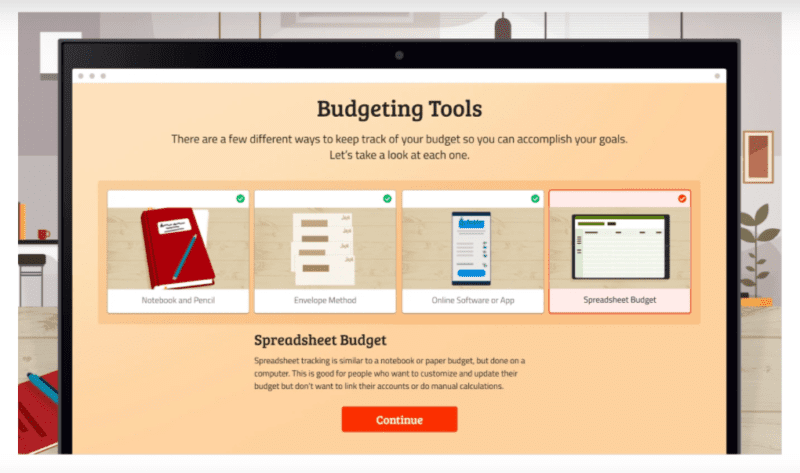

2. How to funds

College students really should understand budgeting fundamentals, this kind of as how to control every month funds. Then, after they detect their budgeting identity, they can build a tactical strategy for placing monetary targets.

Consider this: EVERFI Financial Literacy for Substantial School, Lesson 3: Budgeting

3. How to commit and grow their cash

Are your college students receiving investing advice from memes? Teenagers really should comprehend the unique strategies to finest protected their economical upcoming. This includes how to allocate property and diversify to harmony chance and reward.

Test this: Marketplaces: Superior School Financial investment Instruction, Lesson 5: Expense sport

4. How to bank

Each and every teenager should have a primary knowledge of how economical establishments like banking institutions and credit rating unions work and the distinct goods they give. Most importantly, college students must fully grasp how to open up and deal with a examining or personal savings account. Include these classes to your math or economics courses to deliver serious-globe economic comprehending.

Try out this: EVERFI Money Literacy for High College, Lesson 1: Banking Fundamental principles

5. How to regulate credit rating and debt

Teenagers really should have a grasp on what credit score is, how a credit rating is calculated, and why it is essential. In addition, they really should know how to apply for a credit card and have an understanding of the functions, expenses, and desire rates linked with credit history cards.

Test this: EVERFI Economic Literacy for Large School, Lesson 5: Running Credit history and Debt

6. How to invest in a car and a household

With so several adverts specific at college students, aspect of rising up is finding out how to be an knowledgeable shopper. Being familiar with how car and house financial loans work is simple facts that will support them navigate the invest in approach when the time arrives.

Try out this: EVERFI Economical Literacy for Superior Faculty, Lesson 4: Buyer Skills

7. How to leverage an accounting history

Accounting is a developing subject with a lot of unique and interesting work opportunities. Support students discover about career paths in accounting that may possibly align with their hobbies, interests, and passions.

Consider this: Accounting Occupations: Limitless Possibilities

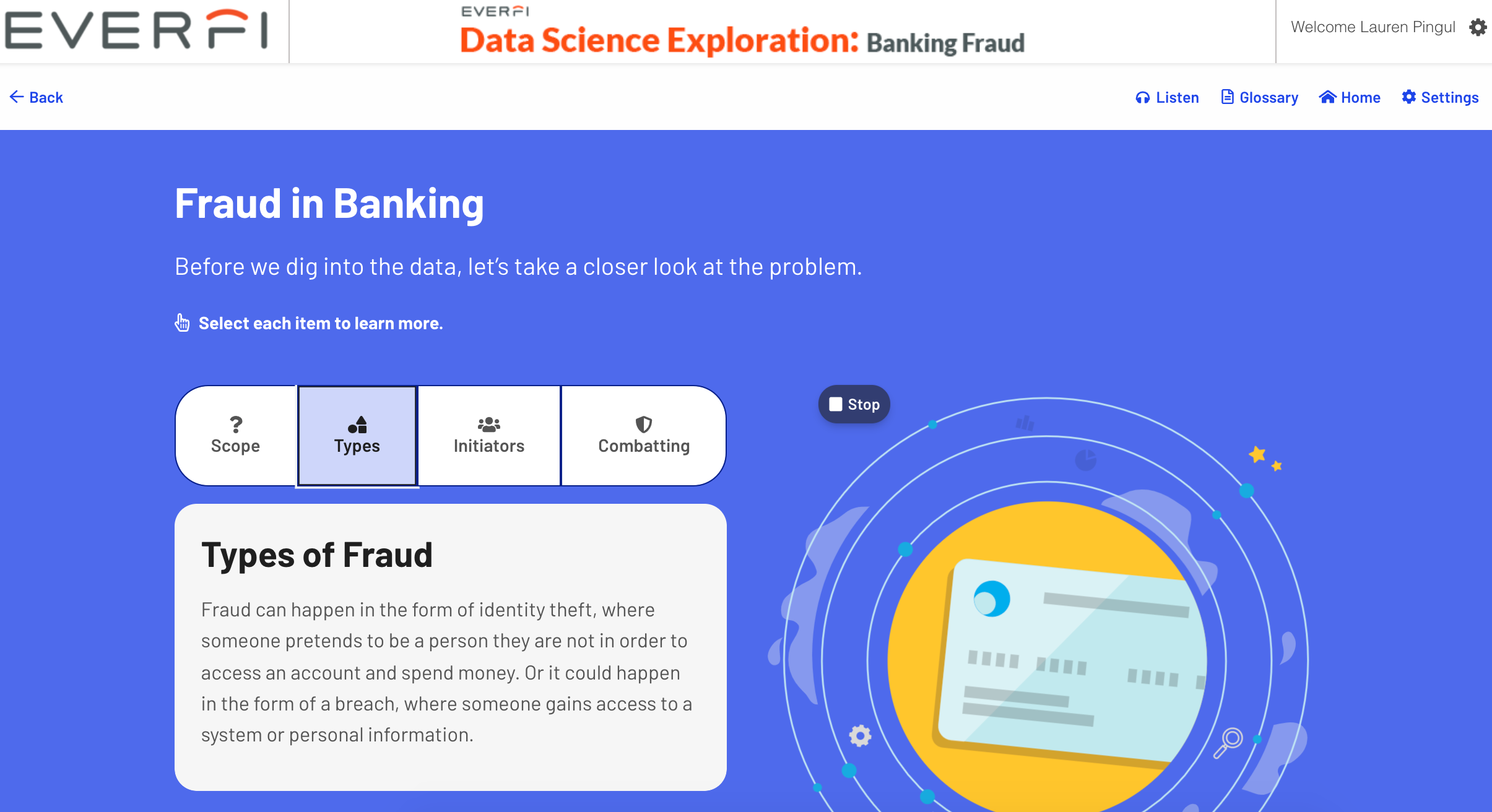

8. How to defend by themselves from fraud and id theft

Teens must have an consciousness of how popular on the web scams derail people’s money stability and identification. They work tough for their dollars and must also know exactly where to turn if fraud does manifest.

Consider this: Info Science Exploration: Banking Fraud

9. How to use cell banking apps

Teens should really have a extensive knowing of how to handle their funds via on the web banking portals and cellular applications. This features the risk-free and liable use of virtual payment apps.

Check out this: Income Moves: Modern Banking & Identification Protection™, Lesson 2: Present day Banking

10. How to system and conserve for university

As teenagers head toward graduation, they should really have a realistic perspective of the expenditures and positive aspects of the faculties to which they are applying. Far more importantly, they ought to know how to navigate paying out for college. Expertise like being familiar with fiscal support and pupil financial loans, how to fill out the FAFSA software, and how to finances for responsible loan reimbursement will set them on the correct route.

Attempt this: Pathways: Funding Greater Instruction Lessons 1-5

11. How to create a enterprise approach and commence your own company

Do you have learners with an entrepreneurial spirit? If so, inspire their curiosity by educating critical organization concepts this sort of as executing the exploration, building business enterprise choices, and creating a profitable business pitch.

Consider this: Undertaking – Entrepreneurial Expedition, Food items Truck Simulation

12. How to help save for retirement

You have read it ahead of, but it bears repeating: It is in no way way too early to get started arranging for the future. As teens enter the workforce, they must be mindful of the great importance of organization 401(k) strategies, pension plans, and the other possibilities accessible.

Try out this: Marketplaces: High Faculty Financial investment Instruction, Lesson 4: Keys to Investing

Seeking for extra means to make cash skills click on for teenagers? Monetary Literacy Month (also known as Monetary Capability Month) in April is the ideal time to leverage these assets. Test out the total economical literacy suite from EVERFI, which is complete of fun and totally free interactive lessons that are uncomplicated to use the two in and out of the classroom.