When the Federal Reserve elevated curiosity prices at its March 22 assembly, quite a few housing marketplace observers presumed that prices for residence loans would before long follow this upward trajectory. Still in spite of these anticipations, home finance loan prices defied the odds and ticked down, for the 3rd straight 7 days.

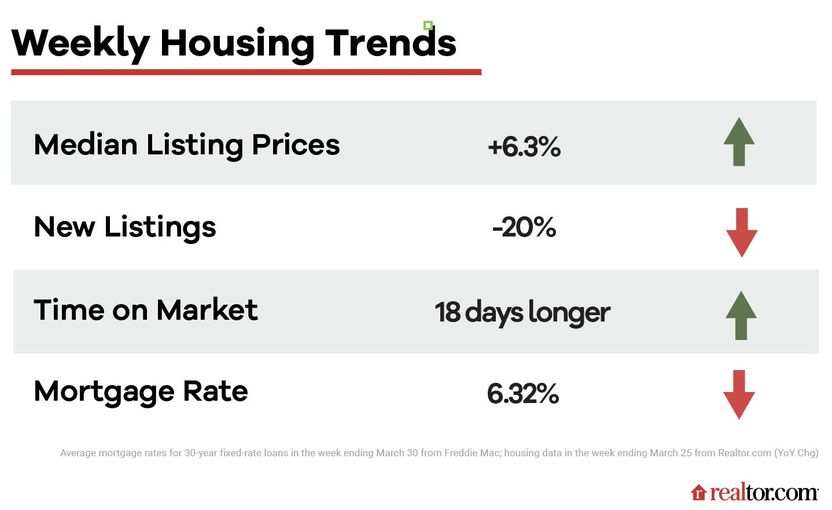

In accordance to Freddie Mac, fees for a 30-year fixed-charge property finance loan have slid from 6.60% in mid March to 6.32% for the 7 days ending March 30.

It is a strong reminder that though the Fed could influence home finance loan premiums, it does not management them. It is also a little window of opportunity for homebuyers who act rapidly to lock in reduced charges that could enable set the fees of home possession in just a lot easier get to.

But “fast” will be the critical word right here, since the property finance loan market place has come to be more untethered and unpredictable than at any time.

“The system of home finance loan premiums is very likely to be bumpy,” notes Real estate agent.com® Main Economist Danielle Hale in her weekly evaluation.

All in all, the spring housing marketplace is shaping up to be a tough trip that will no question effects how many homebuyers and sellers can tummy the ups and downs.

As Hale clarifies, “Looking ahead, home finance loan rates will participate in a significant job in the quantity of activity we see in the housing current market this spring.”

In this hottest installment of our column “How’s the Housing Sector This Week?“, we’ll decipher what this all signifies for homebuyers and sellers who are trying to come to a decision whether to dive into these choppy waters.

Why homebuyers are however having difficulties

For homebuyers trying to navigate today’s rocky housing market place, property finance loan premiums are just a person of several difficulties on their plate.

One more concern is that household price ranges continue to be stubbornly significant. Listings for the 7 days ending March 25 were 6.3% additional highly-priced than this identical week past year. And with March’s median inquiring price tag hovering at $424,500, that is continue to “higher than all but the priciest 6 months of 2022,” Hale details out.

The fantastic information is that charges are expanding at a gradual, one-digit amount, and those expansion rates are most likely to proceed tapering and may possibly even flip adverse this summertime. Even now, this in all probability isn’t happening rapid adequate for most residence hunters.

Another issue homebuyers are grappling with is the woeful lack of new houses. For the 7 days ending March 25, 20% fewer new listings strike the market place verses this similar week a yr previously. Extremely, the range of new listings was almost on par with the small touched way back in April 2020, when a great deal of the entire world was in lockdown amid the to start with waves of the COVID-19 pandemic.

With less newly-outlined homes for sale in the most the latest week, and at better prices, buyers are largely unsatisfied with their potential clients. Home acquire sentiment declined in February and quite a few have only dropped out of the sector, leaving the several who remain with a dubious edge.

“The market is considerably less competitive than it has been the prior two decades,” claims Hale, “but in massive section simply because bigger dwelling selling prices and home finance loan rates have built it challenging for lots of to navigate the superior expenses.”

Why the housing sector slowdown continues

Even nevertheless there are fewer new listings, there’s a whopping 57% additional residences for sale. But lots of of individuals listings are a lot more mature. Homes for sale are spending, on regular, 18 more days on the industry than they would have a calendar year before.

“What I am seeing is residences sitting on the marketplace longer,” suggests Denise Supplee, a true estate investment educator at SparkRental and a true estate agent in the Philadelphia region. “Bidding wars are not as prevalent. I personally imagine that the curiosity prices are scaring purchasers, each newcomers and the savvy purchasers. I have had one particular purchaser determine to maintain off on advertising their home to invest in one more.”

As for what she thinks is future for her marketplace, Supplee claims, “I do believe that we will see a slowdown, and the closely favored seller’s industry tilt in direction of the customer.”

In the meantime, may will preserve a shut eye on the Fed and what its moves sign for the financial system at massive.

“Investors will examine whether each individual new piece of data indicators that the prolonged-awaited finish of monetary tightening, that the Fed acknowledged is now nearer on the horizon, is finally in the rearview,” claims Hale. “Until then, fairness-prosperous owners are most likely to keep on to have an edge.”