The housing current market currently remains in a hazy no man’s land, with neither buyer nor vendor keen to surrender what little management they have.

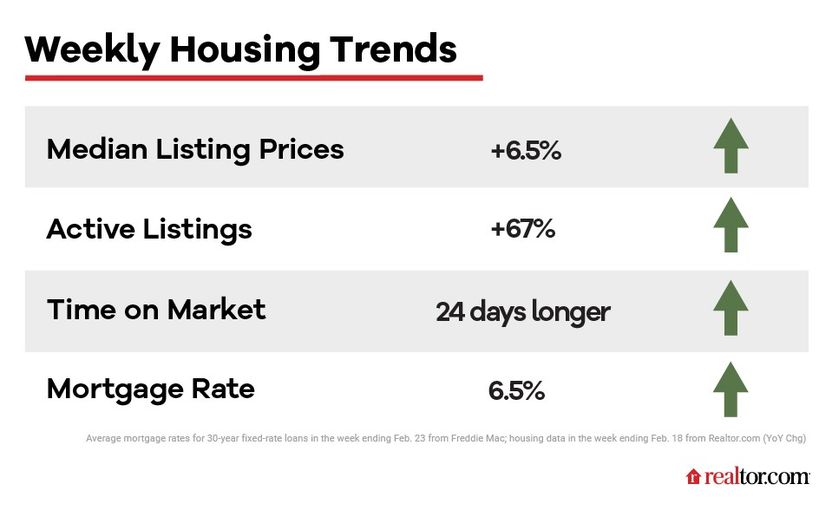

Potential buyers encounter the dual enemies of large house rates and house loan rates, which have been bouncing concerning 6% and 7% this year and ticked up this week to 6.5%, according to Freddie Mac.

Sellers bear their have hardships: a glut of opposition. As consumers sit on the sidelines, households for sale linger on the current market, gathering dust and dashing sellers’ hopes of bidding wars and over-asking features.

But there is some inkling of a electricity shift in the buyers vs. sellers battle, and it’s in favor of the staff eager to acquire some motion: buyers.

“Perhaps amazingly, facts indicates that a lot of customers are nonetheless obtaining achievements in this demanding market, with the homeownership rate notching its highest fourth-quarter reading in above a ten years of 65.9%,” suggests Real estate agent.com® Economist Jiayi Xu in her evaluation of housing info for the week ending Feb. 18.

We’ll drill down into what the latest true estate statistics indicate for homebuyers and sellers in this most current installment of “How’s the Housing Sector This Week?”

Why homebuyers may have the higher hand

Prospective buyers who can make it previous the market’s affordability worries can exploit what positives they have on their side—namely, properties galore.

Without a doubt, the quantity of houses for sale for the week ending Feb. 18 is notably greater, up 67% from just one calendar year in the past. And which is mainly because listings are sitting down on the current market extended.

And that ballooning stock has resulted in sluggish 12 months-above-year asking price tag progress of just 6.5%—the most affordable pace since June 2020.

Sellers are probable pricing their properties reduced in an attempt to stand out from the crowded market.

And these softening rates spell an prospect for prospective buyers, who can use their electric power situation to negotiate with desperate sellers for an even improved property price tag to offset significant property finance loan charges.

“The harmony is shifting towards individuals who are actively shopping,” claims Xu.

Nonetheless one draw back for residence hunters is that, although they have loads of listings to peruse, several of them are stale, meaning they’ve been lingering on-line for months. As this sort of, many potential buyers may have previously picked in excess of and handed on these clunkers currently.

In reality, for the week ending Feb. 18, the quantity of fresh listings that have just hit the market—the lifeblood of a healthy real estate market—is down 18% in contrast with this exact 7 days a yr before. This marks 33 consecutive months that fewer sellers have outlined their properties, displaying just how reluctant they are to experience this strange new environment.

___

Check out: 3 Essential 1st Steps for Buying a Household

___

A bright location for property sellers

Even though homeowners are less interested in providing than they were a calendar year in the past, there is a light at the finish of the tunnel.

Households put in 24 additional times on the sector in contrast with a year previously, marking 29 weeks that houses have been for sale extended. At very first blush, this could possibly seem to be like negative news for weary sellers. However it signifies that the market place is course-correcting, which will in the end be excellent for sellers and prospective buyers alike.

“A slower industry rate is truly a return to what was normal right before the [COVID-19] pandemic turned a extended-expression housing under-provide into shortage on steroids,” says Xu.

So irrespective of the days a dwelling spends on the marketplace hovering as significant as 75 in January, that figure is nonetheless low compared with pre-pandemic averages.

“January income data reveals a ongoing drop in product sales of current households, but at a slower rate,” suggests Xu. “While gross sales aren’t returning to pre-pandemic ranges anytime before long, there are reasons to suspect that the worst of the downturn may possibly be in the earlier.”