We are off and going now, as seasonality has kicked into whole equipment with the obtain software knowledge. And, so much, it is been a great commence to the 12 months.

Here’s the housing marketplace rundown for the previous week:

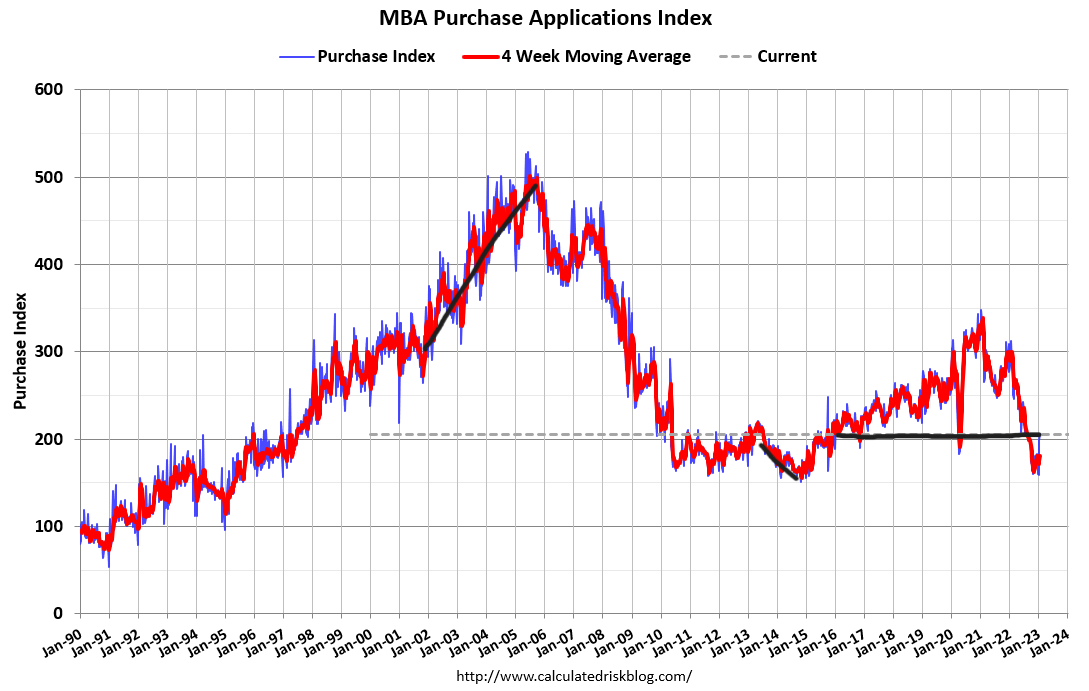

- Acquire software info showed favourable weekly advancement all over again — and the bounce from the base is additional apparent now.

- Housing inventory lowered by 6,468 models, a much more pronounced decrease from the previous 7 days.

- The 10-12 months produce simply cannot crack lessen from the essential level I have reviewed, so not a great deal is going on with home finance loan costs.

When I communicate about seasonality, I am chatting about the next week of January to the first week of May perhaps. Total volumes customarily slide soon after Could, so you can get a superior sense of how spring is turning out by the conclusion of March.

We have experienced back again-to-again weekly development of 25% and 3%. Nonetheless, the essential is that the calendar year-over-12 months declines have stopped likely lessen, and we have risen significantly increased from the base.

Try to remember, nevertheless, that this is usually the case. We had a waterfall dive in buy apps in 2022 — a historic dive, I would say — so there is a shallow bar to bounce off of. Does this move have additional legs to operate, and will we need to have lower mortgage loan rates to get additional development in this data line?

The important with purchase software knowledge is that this info line appears to be like out 30-90 days, so the development we see below takes about 30-90 times at bare minimum to strike the sales facts. As I have stressed for some time, this information line started off to make improvements to on November 9th, 2022. It will consider right until February or March to see it in revenue facts for January and February.

The most the latest pending household revenue info from past 7 days went positive this operates in line with what we saw starting in November and December. It’s low bar bounce for now, but the bleeding in housing has stopped, and we are exhibiting some advancement.

We focus on the weekly information to give us a forward-seeking strategy of the place revenue are heading. Hopefully, the proof I have proven you higher than, and the simple fact no person else was talking about how the obtain software info internals were being acquiring greater starting off from November 9th, will give you some faith in my models — variety of like the “America is back” restoration design of 2020.

Weekly housing inventory

There is, all over again, a different draw back report on weekly inventory, as stock has fallen noticeably yet again this 7 days from the week prior. We are jogging into a timeline the place the inventory can drop just since demand from customers has picked up marginally from the lows, and I am retaining an eye on it.

I was worried about how quick inventory was slipping earlier in the year, and then we paused for about two weeks. Having said that, it has now fallen all over again, and stock decreased by 6,468. This is not what I want to see, but this is the actuality of the planet we live in write-up-2020.

Hopefully we get the seasonal stock press sooner in 2023 than we did in the very last two a long time, but fortunately, inventory is continue to bigger this yr than final calendar year.

- Weekly stock modify (Jan. 20-27, 2023): Fell From 472,122 to 465,654

- Similar 7 days previous 12 months (Jan. 21-28, 2022): Fell from 276,865 to 271,954

In June 2022, I predicted that as prolonged as house loan fees stayed significant, weakness in demand about time could make more stock — and we could get back to 2019 stages of inventory in 2023, which means inventory breaks in excess of 1.52 million using the NAR inventory degrees.

Right soon after I built that forecast, new listing facts begun to decrease earlier and more quickly than standard, which place a significant dent in the forecast. This forecast will get even more complicated if the weekly stock stages do not mature.

The NAR knowledge lags a bit, but the most recent present house profits report exhibits inventory broke to beneath 1,000,000 once again. This is only the next time in the latest modern-day-working day background that inventory starts the yr underneath 1,000,000.

NAR overall stock is now at 970,000.

It will be critical that we hold an eye on order applications and inventory levels likely into spring, as we really should see the standard stock increases that have transpired every single spring period outdoors of 2020. The dilemma is: Will the increased desire traits consume into the stock growth, and is this happening already?

Even with the significant hit in demand from customers in 2022, it’s been a wrestle to get total inventory degrees back again to 2019 levels, which were the four-decade reduced in lively listings prior to the Covid 19 pandemic hit us.

I would like the conventional spring time inventory stages to develop faster than we have observed in the previous two yrs. As of now, this hasn’t took place still — at the very least not in any significant way. Nevertheless, I am incredibly grateful that total stock amounts are higher this yr than past year.

10-yr yield and house loan rates

There was not considerably motion in mortgage loan fees final 7 days. The 10-12 months produce has simply just been unable to split beneath the critical stage I have been conversing about of 3.42%-3.45%.

For now, we are just floating all around involving 6.15%-6.21%, the home loan rates final 7 days. This occurred whilst very last week’s PCE inflation information confirmed a awesome down continuation of the expansion charge of inflation. That inflation info did not shift the industry.

Component of my 2023 forecast for the 10-yr produce is that if the financial system stays organization, the 10-year produce selection should be between 3.21%-4.25%, that means house loan rates amongst 5.75%-7.25%. With financial weak spot, bond yields could rapidly drop to 2.72%, using home loan rates in close proximity to 5%.

The economic details has been agency plenty of to retain the economic downturn converse at bay as the labor industry is however holding up. On the other hand, we have a great deal of knowledge coming up upcoming week — and a Federal Reserve conference.

The week ahead

We will have a chaotic week many thanks to the Fed assembly, task openings data, jobless claims facts, and the Friday work opportunities report — all of which could go the marketplaces. Oh my, it is going to be pleasurable!

The Fed desires to see labor markets and wage expansion weakness. We will see if Chairman Powell has nearly anything to say about existing marketplaces betting on upcoming fee cuts.

This week, we’ll also study regardless of whether the occupation openings knowledge falls or grows. A decrease in work openings is a little something the Fed believes will deliver down inflation, as occupation openings are much too significant for their taste. Although wage advancement is cooling down, the Fed prefers to see extra weak spot in the labor facts.

I will also be browsing the wonderful point out of Texas and speaking in Houston and San Antonio.

Any weak point in the labor industry and wage development should shift bond yields reduced. Even so, as I have talked about for the previous handful of weeks, it’s been tricky for bond yields to crack lessen recently. For example, in spite of the very clear downtrend in the PCE inflation report final Friday, bond yields did not go down that working day.

We have a occupied and essential week forward of us, which will cap off the remarkable thirty day period of January. Overall, we have experienced a beneficial thirty day period in housing data in January, but I would like to have noticed extra inventory by now. Nonetheless, the simple fact that we are above very last year’s ranges is a as well as for everyone.

We will keep a close eye on all the knowledge this week to supply the most up to date take on the U.S. housing marketplace.