We only have 2.6 months’ well worth of housing stock in the U.S. just after coming off the one biggest household-gross sales crash 12 months in record. That is where by we are nowadays in The usa. As expected, existing house income fell from February to March since the prior month’s report was intensive.

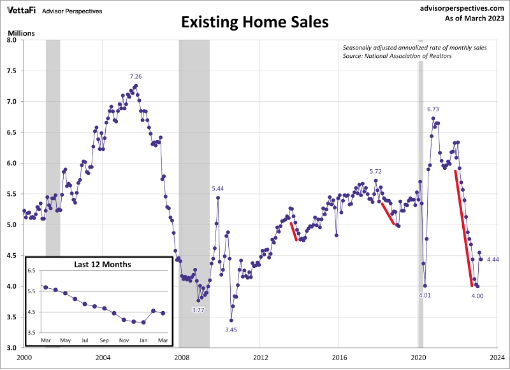

We have a workable range for 2023 gross sales in the existing home sales marketplace concerning 4 million and 4.6 million. If we are trending down below 4 million — a likelihood with new listing information trending at all-time lows — then we have significantly weaker need than folks consider. Now if we get a handful of revenue prints above 4.6 million, then need is greater than the original bounce we experienced previously in the calendar year.

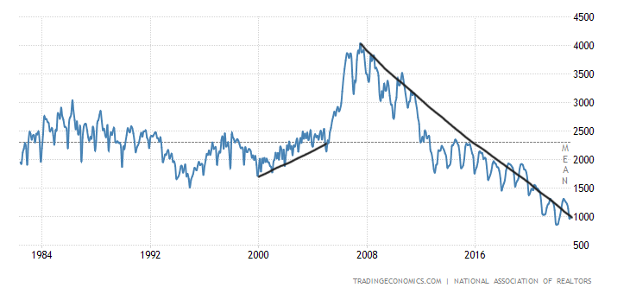

To get again to the pre-COVID-19 product sales assortment, we need to see existing property profits development between 4.72 – 5.31 million for at least 12 months. That is not taking place. We are operating from a lower bar, and as I have stressed in excess of the many years, it’s sporadic publish-1996 to have a month-to-month revenue development below 4 million. In the chart underneath, with the crimson lines drawn, you can see how distinct the profits crash in 2022 was compared to the previous two instances premiums rose and gross sales fell.

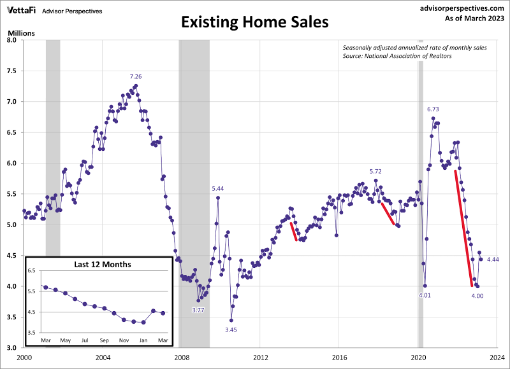

From NAR: Total present-house income – finished transactions that include things like one-family members properties, townhomes, condominiums, and co-ops – fell 2.4% from February to a seasonally modified yearly fee of 4.44 million in March. Calendar year-more than-yr, revenue waned 22.% (down from 5.69 million in March 2022).

Past yr we had a major revenue decrease for the existing dwelling product sales market, which acquired worse as the yr progressed. When wanting at year-over-12 months details for the relaxation of the yr, we have to keep in mind that the calendar year-more than-12 months profits declines will enhance just due to the fact the comps will get less complicated. That will decide up velocity towards the 2nd half of 2023 and we could see some positive calendar year-above-calendar year facts toward the close of the calendar year.

NAR: 12 months-about-year, sales waned 22.% (down from 5.69 million in March 2022).

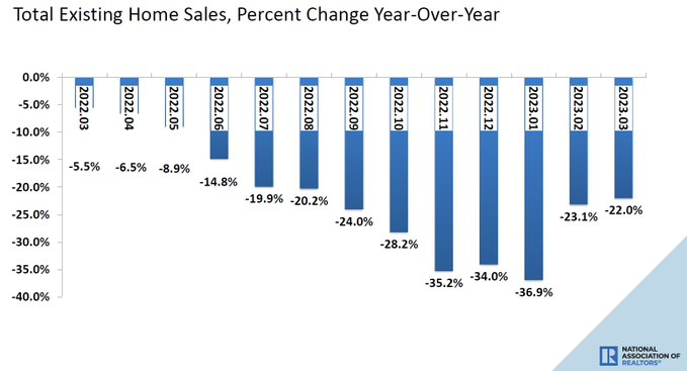

1 factor I didn’t like to see in this report is that the times on sector fell and are back to beneath 30 days. This is the actuality of our globe: total energetic listings are however near all-time lows and demand from customers so significantly has been secure considering the fact that Nov. 9, 2022.

As we can see in the data underneath, the days on the sector fell again down to 29 days. I am hoping that it does not go lessen than this. For some historical context, again in 2011, this knowledge line was 101 times.

NAR: To start with-time potential buyers were responsible for 28% of sales in March Personal investors purchased 17% of houses All-cash gross sales accounted for 27% of transactions Distressed revenue represented 1% of revenue Qualities generally remained on the sector for 29 days.

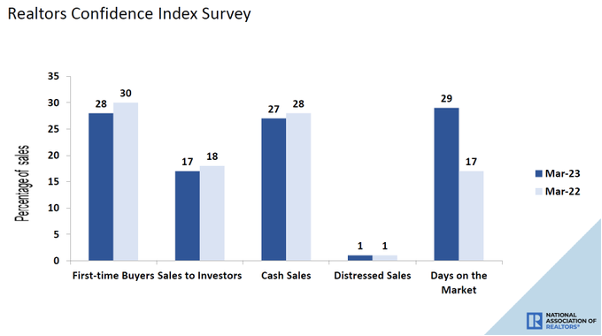

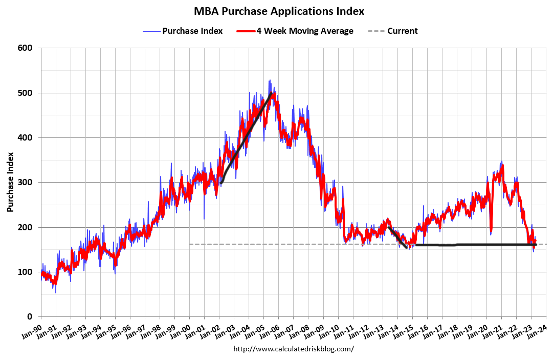

When I speak about stabilization in demand from customers given that Nov. 9, I am seeking at purchase application details given that that date, and — excluding some getaway weeks that I really don’t put any bodyweight on —we have experienced 15 beneficial prints vs . 6 destructive prints in that time. So, when the chart down below does not appear like what we noticed in the COVID-19 restoration, it has stabilized.

I set the most bodyweight on this knowledge line from the second 7 days of January to the first week of Could. Immediately after Could, usually speaking, whole volumes normally slide. Now, put up-2020, we have had a few straight several years of late-in-the-year operates in this facts line to mess almost everything up. Even so, sticking to my previous do the job, I have viewed 8 favourable prints as opposed to 6 detrimental prints this calendar year. So, I wouldn’t get in touch with this a booming demand from customers drive bigger, just a stabilization interval applying a minimal bar.

NAR: Complete housing stock registered at the end of March was 980,000 units, up 1.% from February and 5.4% from 1 year back (930,000). Unsold inventory sits at a 2.6-month supply at the present gross sales rate, unchanged from February but up from 2. months in March 2022.

Whole housing stock, even though up year above yr, is even now close to all-time lows, and every month supply is also up 12 months over yr. Nonetheless, as we all know, housing inventory achieved an all-time low in 2022, so you need context when chatting about the yr-around-year information. As we can see down below, from 2000, overall lively housing inventory rose from 2 million to 2.5 million ahead of we observed the significant worry spike in supply from 2005 to 2007.

The NAR facts seems a little bit backward, so if you want more clean weekly facts, I compose the Housing Sector Tracker each individual week on Sunday night to give you that data.

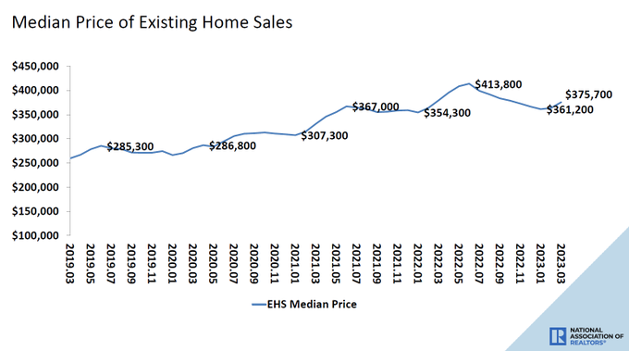

One particular point higher mortgage fees have carried out for confident is that house-value expansion is cooling down noticeably considering the fact that the massive spike in premiums. That advancement isn’t cooling as significantly as I would like, tied to my a long time 2020-2024 price tag-growth model for a secure housing marketplace. Having said that, I will take what I can get at this level.

NAR: The median present-home price tag for all housing varieties in March was $375,700, a drop of .9% from March 2022 ($379,300). Rate climbed a bit in 3 regions but dropped in the West.

The most surprising data we have viewed in the housing market considering the fact that the big crash in residence gross sales is how lower stock even now is in the U.S. — apart from for people looking at HousingWire or listening to the HousingWire Everyday podcast.

Recall, stock channels are different now because credit score channels in the U.S. are distinctive put up-2010. Also, demand has stabilized because Nov. 9, so when we communicate about housing in the U.S., let’s use the information that makes feeling.

Secure demand from customers, low housing inventory, and no forced sellers are why we established the weekly Tracker, to aim on accurate facts and what issues most to housing economics and the U.S. economic system.