Significant-volume property sellers are in a bit of a pickle in today’s market many thanks to promptly climbing home loan charges final calendar year.

“We’re just attempting to move stock speedily,” said Lee Kearney, a Tampa, Florida-primarily based true estate trader who has an stock of between 15 and 20 homes for sale at any offered time. “If it’s not going, modify the pricing so it does transfer. These are industry-dependent decisions.”

Kearney’s basic system for surviving as a high-volume seller in an setting the place need has dried up: hear to the market and do what it claims.

“As a vendor if one thing is sitting out there a couple months and it is not promoting, the cost is also significant,” said Kearney, who has been investing via multiple authentic estate cycles and thinks housing will not be rebounding significantly in the around time period. “There’s no superior news all-around the corner. If you believe that assertion, then the action product is to decreased the price tag.”

Although there have been some current favourable signs in the housing and work markets, these indicators place to stubbornly higher inflation and a corresponding stubbornness on the element of the Federal Reserve to carry on boosting fascination rates more than the lengthier time period to struggle inflation. A extended-term battle versus inflation lowers the chance of sustainable very good news in the housing industry and raises the danger of a coming economic downturn.

iBuyers pull again in this housing marketplace

Even though he is remaining a lot a lot more selective in his acquisitions, Kearney has not stopped acquiring houses completely, a technique that some much larger institutional buyers adopted in selected Tampa neighborhoods in late 2022. People neighborhoods are now emotion the most discomfort in terms of value decline, according to Kearney.

“The $500,000 property is now $450,000. It is an desire charge calculation,” he claimed. “Especially cookie cutter neighborhoods the place the iBuyers pulled out.”

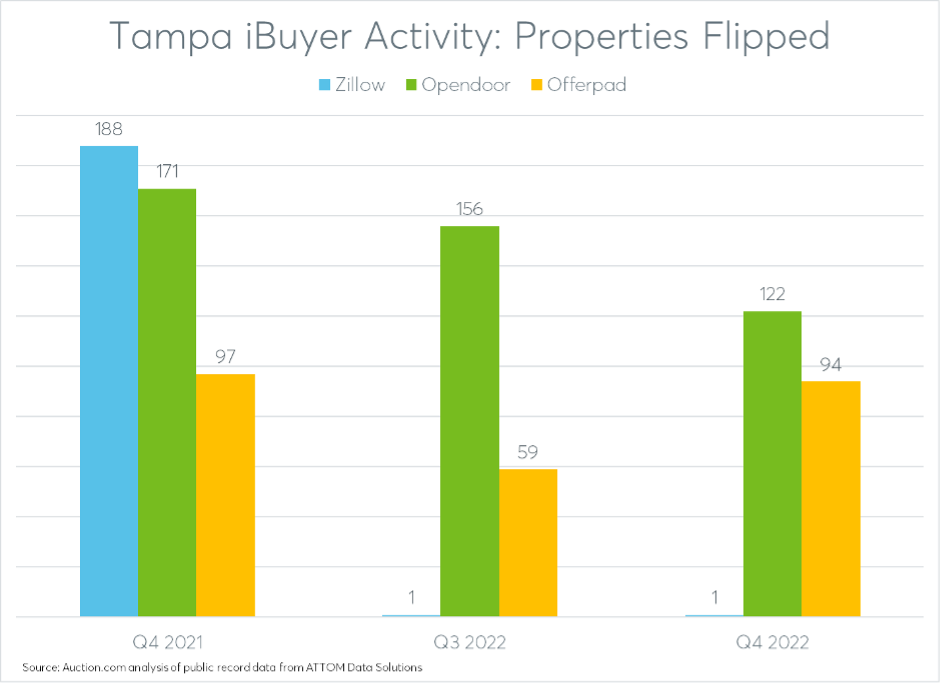

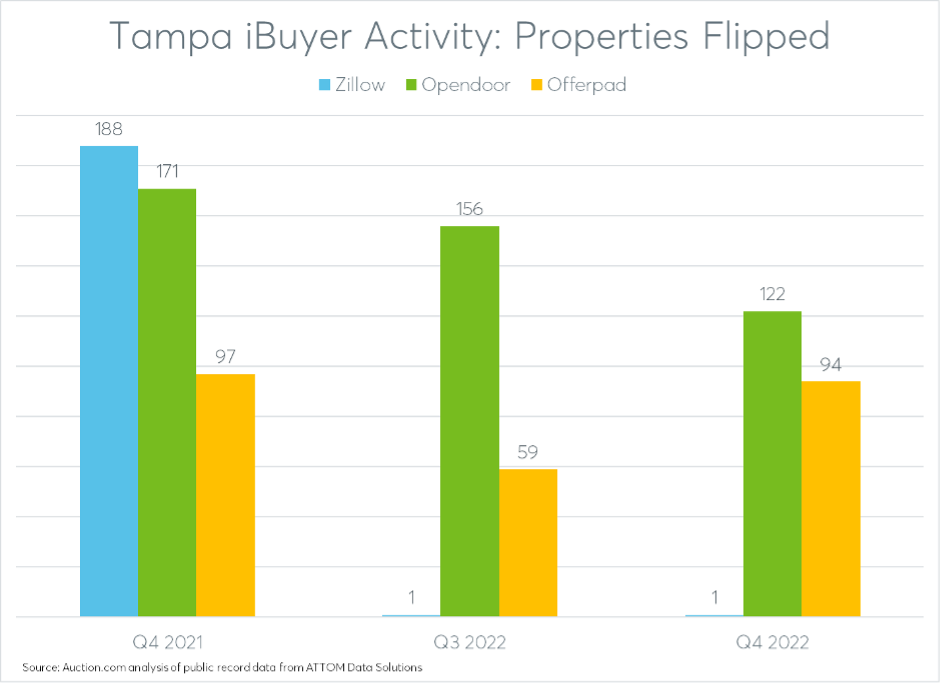

An Auction examination of general public record knowledge from ATTOM Data Options shows iBuyer exercise residence flipping action in the Tampa Bay metro location dropping 52% in Q4 2022 in contrast to the yr prior to. The drop was driven principally by a 99% reduce in residences flipped by Zillow, but Opendoor household flipping exercise was also down 29% in excess of the exact same interval and Offerpad dwelling flipping exercise was down 3 p.c.

Opendoor lost an ordinary of $6,000 on Q4 2022 flips, down from an typical achieve of approximately $16,000 for each property for houses flipped in Q4 2021. Offerpad’s Q4 2022 flips continue to generated an normal gross achieve of approximately $12,000 for each property (not which includes holding, rehab or selling expenses), but that was down 69% from the typical attain of a lot more than $38,000 for each property a yr prior to. The just one property that Zillow flipped in Tampa in Q4 2022 marketed for a whopping $173,000 a lot less than its invest in price tag. In Q4 2021, Zillow’s 188 house flips in the Tampa metro region averaged a gross acquire of about $7,000 for each residence.

Distressed home pricing approaches

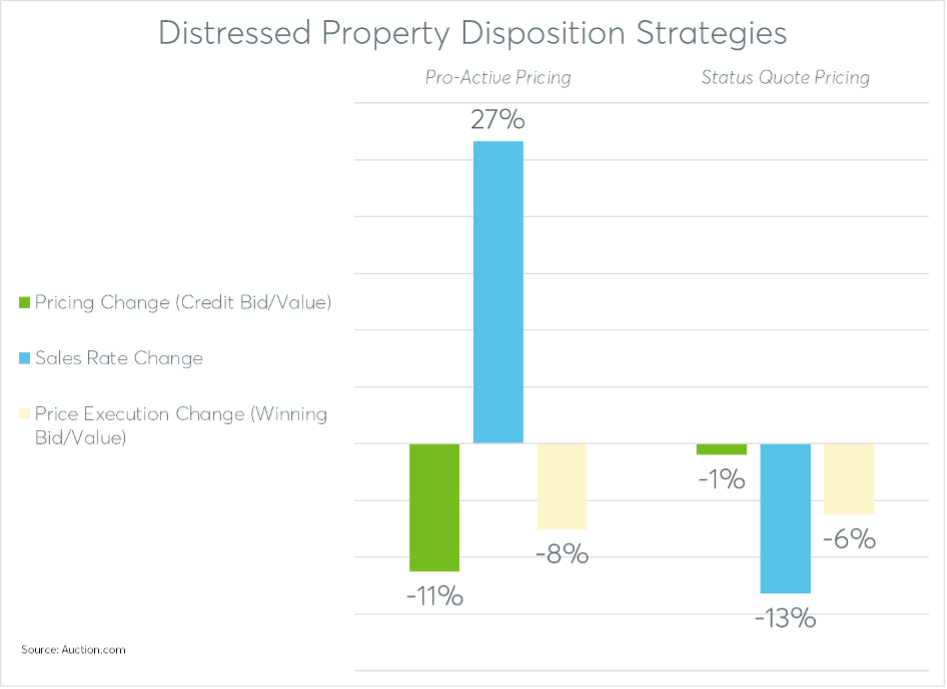

Information from the Auction.com 2023 Distressed Market place Outlook report displays how a different sort of institutional vendor — creditors who are providing at foreclosures or lender-owned auction — are adjusting their disposition tactics in reaction to downshifting desire.

In the fourth quarter of 2022, the most proactive of these lenders began changing their credit rating bids at foreclosure auction reduced, thus retaining a product sales level of 50% or more at the foreclosure auction. By protecting that best foreclosure auction product sales level, these proactive loan companies are equipped to minimize disposition losses although also mitigating the risk of keeping qualities as genuine estate owned (REO) in a marketplace the place residence price ranges are flat or falling.

The fourth quarter adjustment by proactive loan companies decreased the normal value-to-benefit ratio for all foreclosure auctions on the Auction.com system by a few proportion factors, from 73% in the 3rd quarter to 70% in the fourth quarter. This was the general ordinary, with the most proactive lenders decreasing credit history bids by a lot more than 5 points.

Individuals most proactive lenders noticed the gross sales charge at foreclosures auction rise well above 50% by the finish of the calendar year when the gross sales rate for all loan companies ongoing to drop, albeit at a slower pace, bottoming out at near to 45% in December.

Best disposition outcomes

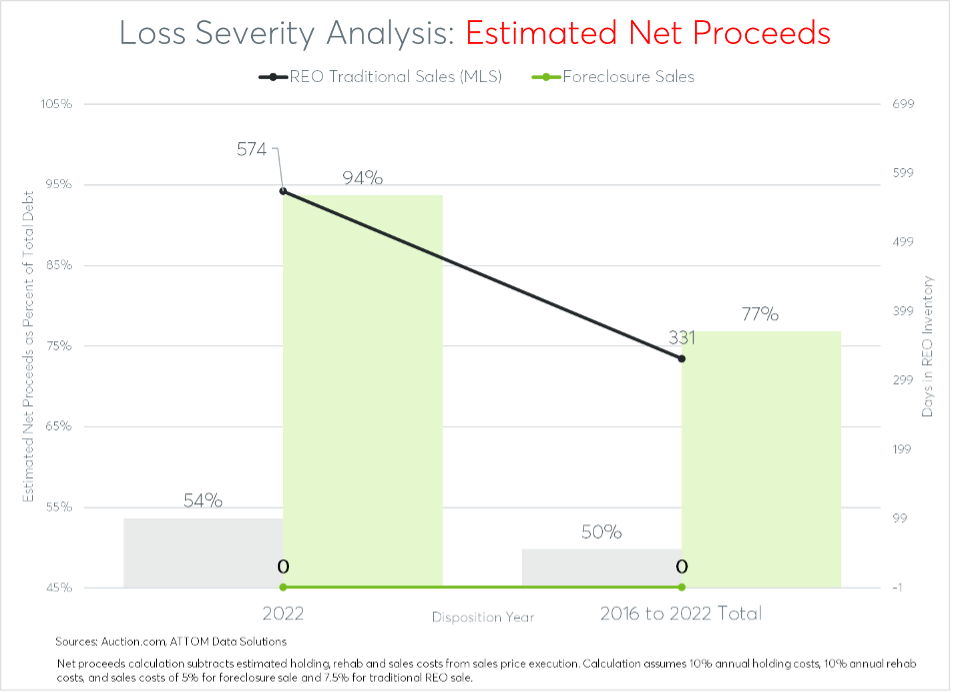

Preserving the foreclosure sales charge earlier mentioned 50% assists distressed property sellers to most effective leverage the disposition channel that has been tested to produce the highest internet proceeds in a wide variety of housing industry situations.

An assessment of far more than 435,000 distressed home tendencies considering the fact that 2016 in the 2023 Distressed Market Outlook report demonstrates that distressed properties marketed at foreclosures auction generate an estimated net proceeds of 77% of the overall credit card debt owed to the foreclosing loan provider. That is 27 proportion points larger than the approximated internet proceeds (50% of whole credit card debt) for homes that reverted to REO and then ended up subsequently bought on the retail market, generally by the Various Listing Provider.

Keeping homes as REO results in being even more risky in a slowing serious estate ecosystem. The functionality hole concerning foreclosure sale inclinations and retail REO sale inclinations widened to 40 points in the downshifting 2022 sector.

Exceptional neighborhood results

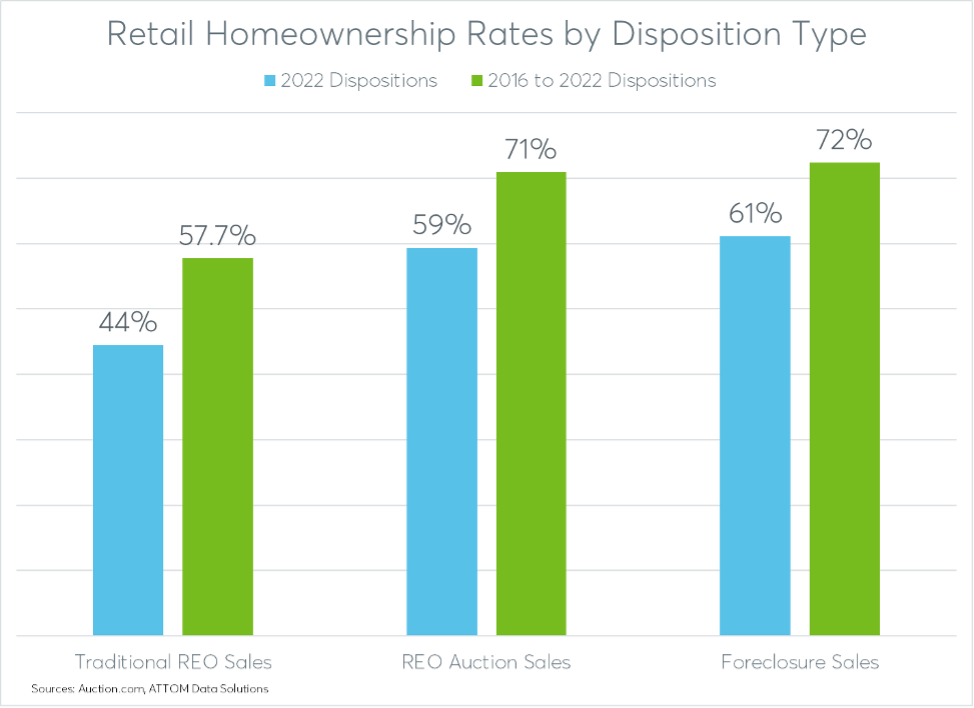

It also turns out that advertising additional house at foreclosure auction lifts homeownership prices and improves residence values. The exact same analysis of 435,000 distressed residence dispositions exhibits that 72% of properties that ended up renovated and resold right after becoming purchased at foreclosure auction finished up in the hands of proprietor-occupants. That was 14 proportion factors larger than the 58% homeownership price for retail REO sales.

The renovated foreclosure sale qualities were being offered for 99% of estimated “after-repair” price, indicating considerable renovation and serving to provide favorable comparable gross sales for other homes in the bordering community. By comparison, the retail REO gross sales sold for 73% of believed “after-repair” sector value.

Irrespective of selling for near to full “after-repair” marketplace worth, the renovated foreclosures homes even now represented somewhat economical housing, specially for family members in underserved neighborhoods.

Renovated foreclosures in reduced-cash flow Census tracts offered for an ordinary price of $211,963 in 2022, with the every month home loan payment on all those properties — which includes assets taxes, insurance plan and assuming a 5% down payment and the regular 30-12 months set home loan fee in the month of the sale — necessitating 22% of the monthly median money for households in the encompassing tract. Renovated foreclosures in minority Census tracts offered for an ordinary rate of $223,227 in 2022, requiring 24% of the median family members revenue in the surrounding community.

To discover additional about pricing properties in today’s sector, pay a visit to Auction.com.