The homebuilders really do not construct millions of houses simply waiting for them to get bought they create homes when they’re self-assured they can provide at the ideal price tag. This business enterprise design indicates that the builders are very mindful of the demand for their solution and continue to keep an eye out on their most important level of competition, the present property marketplace, exactly where offer is less expensive for a purchaser.

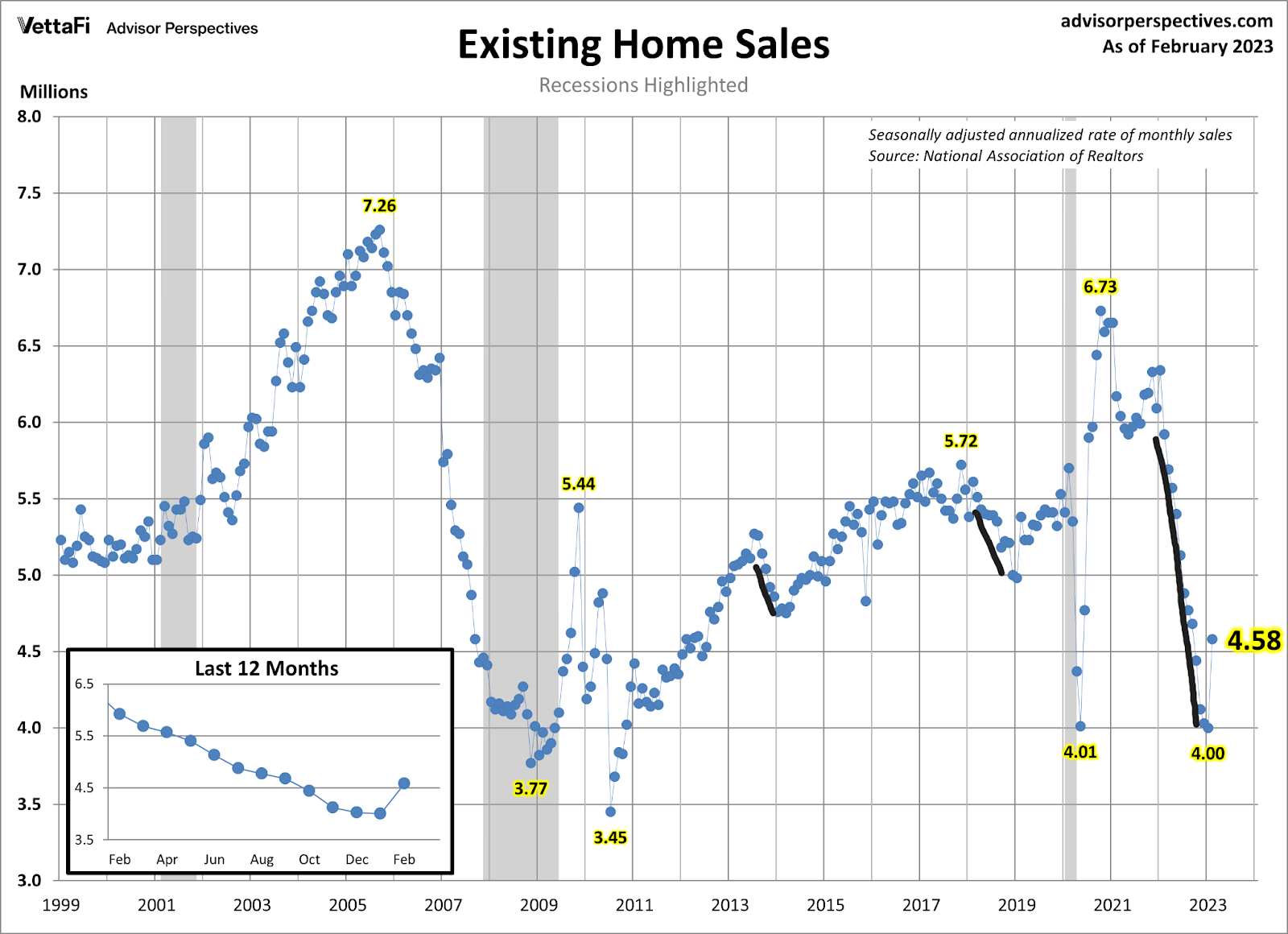

Back in 2007 — right after existing household profits got as low as we have noticed in the latest knowledge as the chart below demonstrates — overall energetic listings had been earlier mentioned 4 million.

Contrast that with the chart under, which demonstrates that the full energetic listing now is 980,000. This is a substantial variation in inventory knowledge and a in addition for the homebuilders, which they did not get pleasure from in 2007.

This means the builders have fewer competitors for their product or service, supplying them time to perform off their backlog. They can slash rates, pay out down mortgage loan premiums for their customers, and do what they want to to make it operate for them to transfer their merchandise. All this is going on when housing permits have fallen significantly from the recent peak.

As housing permits continue to keep slipping, we really should be viewing falling housing completions.

Nonetheless, owing to the COVID-19 delays, the homebuilders are continue to doing the job through their backlog of residences, and with a whole lot much less competitiveness this time all around, they have extra time to do this.

As I have pressured time after time, we shouldn’t be using the housing financial types of 2002-2008 — that would have led absolutely everyone to believe that we had a mass source of housing coming on the web in 2022. We didn’t have the credit score anxiety situation from 2010-2023 like we did from 2005 by 2008. As you can see, this was a blessing for the builders though they labored off the backlog of residences.

New household gross sales

From the Census Bureau: Product sales of new one-spouse and children properties in February 2023 had been at a seasonally altered once-a-year price of 640,000, in accordance to estimates launched jointly now by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.1 percent (±15.3 percent)* over the revised January price of 633,000, but is 19. percent (±12.9 percent) down below the February 2022 estimate of 790,00.

As we can see in the chart below, we have only noticed a minimal motion in the new dwelling gross sales sector for several months, apart from when house loan prices fell and homebuilders could shift additional properties. Costs did spike from 5.99% to 7.10% not long ago, impacting the data coming up. Even so, consider if the housing current market could get home loan charges beneath 5.75%, then head towards 5% and keep there for some time. That will be a significantly superior atmosphere for the builders.

From Census: For Sale Stock and Months’ Provide The seasonally altered estimate of new properties for sale at the close of February was 436,000. his represents a source of 8.2 months at the present-day revenue price.

I have a clear-cut model for when the homebuilders will get started issuing new permits with some kick and duration. My rule of thumb for anticipating builder conduct is based mostly on the 3-thirty day period supply normal. This has nothing at all to do with the present residence product sales current market this monthly source data only applies to the new dwelling gross sales market place, and the present-day 8.2 months are as well significant for them to concern new permits with any organic steam.

- When provide is 4.3 months and under, this is an fantastic marketplace for builders.

- When source is 4.4 to 6.4 months, this is an Okay builder industry. They will establish as prolonged as new property income are escalating.

- The builders will pull back on construction when the source is 6.5 months and above.

So, as we can see beneath, the homebuilders are no more time working with spiking source facts but a gradual-going downtrend that however needs considerably do the job. Nevertheless, there is a good deal much more to this tale.

We have had quite a few people on social media web-sites expressing a enormous housing provide will strike the market place before long since we have a record total of residences beneath construction. This truly isn’t how the supply channels operate for the builders.

As we can see in the chart down below, even through the worst times of the housing bubble crash, the builders hardly ever experienced 200,000 houses readily available for sale. In normal moments we are amongst 80,000 and 100,000 households for sale. Right here is a breakdown of the supply info in today’s report.

8.2 months of offer equals:

- 1.4 months of concluded properties: 72,000 homes

- 5. months of residences below design: 269,000 properties

- 1.8 months of provide that haven’t even been started out: 95,000 households

In the chart below you can see the context of the 72,000 new residences available for sale right now.

In general, new home profits have been additional of the exact same tale for several months now. When home finance loan prices slide, homebuilders can shift far more product or service, but not substantially is going on for this sector right up until the backlog of households can get off their publications and monthly source can get under 6.5 months.

At the time that takes place, new home gross sales will commence to increase again enough that the builders problem additional permits. The builders are experience a great deal much better about their prospective buyers, as the the latest builders’ self-assurance data demonstrates. Keep in mind, context is crucial the builders’ confidence is coming off a historic dive with nothing at all to do with the COVID-19 delays.

Home finance loan premiums have been all about the map this yr, but have still to crack higher than our highs final yr. Lately they have occur down, and the past three weeks experienced favourable acquire application details, which offset the three weeks of negative obtain software knowledge we experienced when rates spiked from 5.99% to 7.10%. If we can just get some tranquil, boring months of home finance loan costs, the strain on the housing marketplace — and all the people trying to purchase and promote homes — will ease.