Home loan prices have dropped still again—could this spell an opportunity for homebuyers?

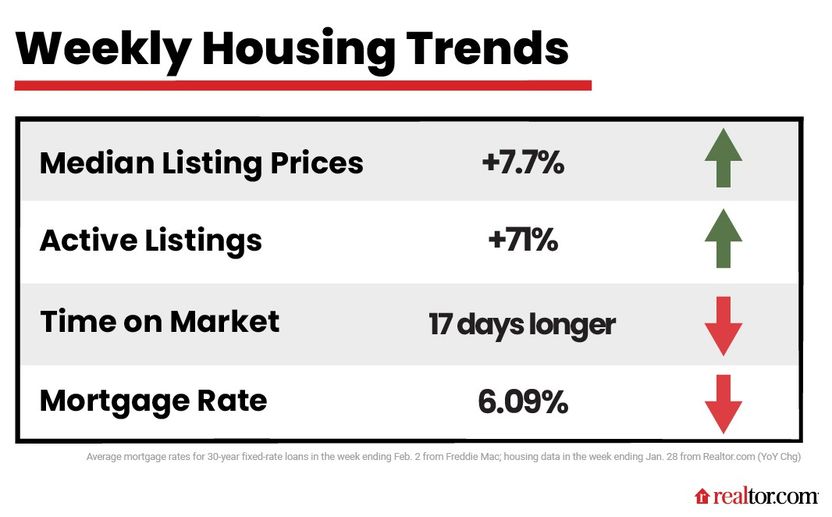

The average interest charge for a 30-year mounted-rate property personal loan fell to 6.09% for the week ending Feb. 2, according to Freddie Mac. Which is down approximately a total share level from October’s 20-calendar year higher of 7.08%.

In the meantime, the number of properties for sale is soaring, flying 71% higher for the 7 days ending Jan. 28 in comparison with this identical week a 12 months before, in accordance to a modern assessment by Realtor.com®.

This dip in home finance loan prices, merged with loads of properties on the marketplace, adds up to a probable win for homebuyers.

“The much less competitive sector could have established prospects for 1st-time homebuyers who are seeking to become property owners in 2023,” suggests Real estate agent.com® Chief Economist Danielle Hale in her evaluation.

We’ll split down what the hottest serious estate figures necessarily mean, and how homebuyers can use them to their edge, in this newest installment of “How’s the Housing Industry This Week?”

Inventory is booming and houses are lingering

Not only are there a lot more households on the current market, but buyers can get their sweet time checking them out.

In January, homes normally sat on the industry for 75 days. And for the week ending Jan. 28, listings lingered 17 days for a longer time in comparison with that identical week a 12 months previously. Which is 27 weeks straight of time on the industry rising.

“This slower market place speed is a welcome aid to purchasers, specifically first-time homebuyers who have to have additional time to feel via their shopping for alternatives,” says Hale.

But what homebuyers don’t have is new listings, which were being down for the week ending Jan. 28, by 9% from a year in the past. The amount of new houses hitting the current market has been on the decline for 13 consecutive months now.

“As house loan premiums continue to be large, householders looking to promote and purchase at the similar time—who are probable to have a great price on their present mortgage—may be pausing their shifting options to see if the market place increases just before placing their property up for sale,” explains Hale.

Residence price ranges are normalizing

In January, dwelling price ranges clocked in at a median of $400,000, down from June’s peak of $449,000. Nonetheless home charges for the 7 days ending Jan. 28 are still up by 7.7% in contrast with this identical 7 days a year before.

So even though rates are continue to escalating annually, they’re tapering off from the double-digit progress that characterized a great deal of 2022.

“The overall selling price development in January continued its downward trend as we go into 2023, suggesting that the normalization carries on in cost advancement,” notes Hale.

The affordability variable continue to looms

Regardless of the trifecta of constructive news in the housing market—more residences for sale, lessen mortgage rates, and stabilizing prices—the affordability challenge continues to be a persistent challenge for a lot of potential homebuyers.

Additionally, Hale predicts, “The Fed’s resolve to combat inflation may hold home finance loan prices remaining at high degrees in the shorter phrase.”

But she also notes that rates could fall in the next 50 % of the year, so property shoppers who aren’t in a position to manage a home now can take coronary heart that 2023 appears brilliant general.

“For purchasers searching at a housing marketplace with a climbing amount of property inventories and retreating selling prices, there is hope that 2023 will supply a lot more alternatives,” claims Hale.