Credit history acquiring tighter

What we ordinarily see likely into recession and in the course of a downturn is credit receiving tighter. What does tighter credit history suggest for housing? It suggests selected house loan items might not be made available, FICO rating needs could be lifted, and it can mean pricing for selected financial loans goes up to account for the possibility.

Having said that, the recent housing market place is considerably different than the credit score growth-and-bust cycle of 2002-2008, and it is crucial to fully grasp why.

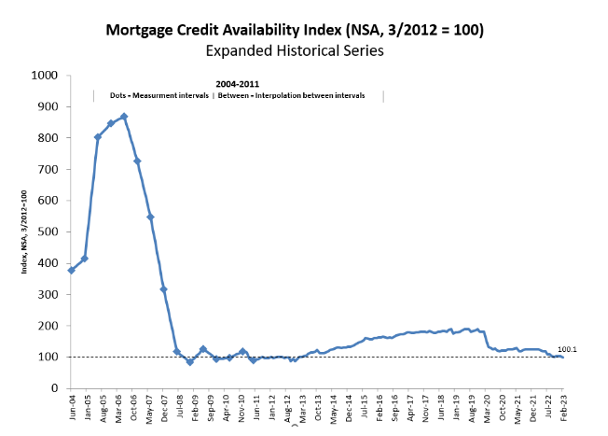

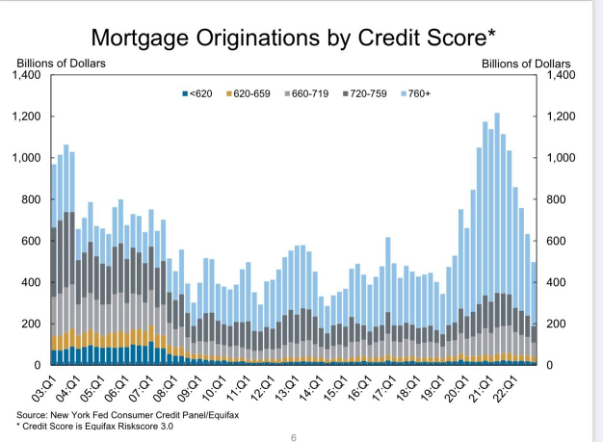

Credit availability was booming for the duration of the housing bubble several years, then collapsed epically. The MBA chart underneath displays what a broad collapse it was then. Now, with new laws in position since the economic disaster, that credit growth and collapse will be a when-in-a-life time function.

Why is this so crucial? About the a long time, just one of my major speaking details has been that we didn’t have a huge credit score housing growth in the U.S. for the duration of the past couple of many years, nor can we ever. Mainly because of the skilled home loan laws of 2010, we are lending to the capability to have the financial debt, which signifies speculative credit rating cycles from most important resident homebuyers or even investors can not occur in the exact fashion as from 2002-2005.

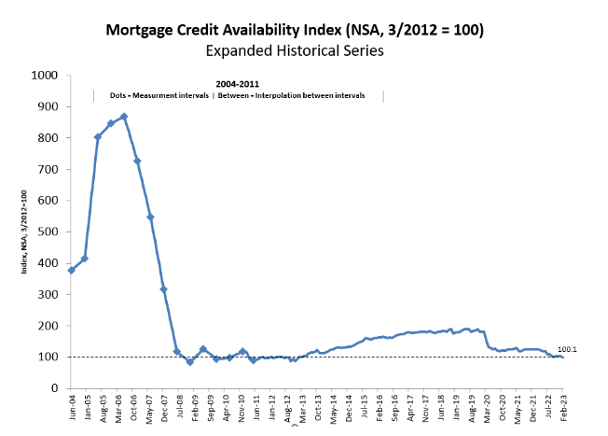

The acquire application information beneath evidently demonstrates this. We had quite a few several years of substantially greater credit rating growth for the duration of the bubble decades and not that a great deal credit rating in the previous handful of several years.

This is crucial because the current dwelling profits market place was booming for the duration of the 2005 peak that marketplace needed credit to stay loose to preserve desire substantial and growing. That is not the situation these days. We had a substantial collapse in demand in 2022, not for the reason that credit history was finding tighter but since affordability was an issue.

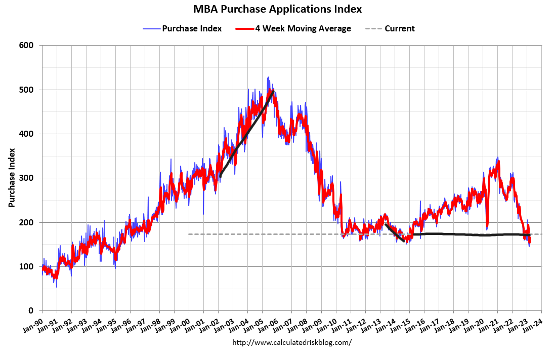

Immediately after premiums fell lately, working from a shallow degree, we saw one particular of the most sizeable month-to-month profits prints in history with the past existing house revenue report.

This significant bounce in demand came from a waterfall dive, and we needed at minimum 12 weeks of optimistic, ahead-hunting data to get this need enhance, but it transpired as home finance loan charges fell. Mortgage loan credit rating can get tight for jumbo loans, non-QM loans and dwelling equity lines, but standard conforming Freddie Mac and Fannie Mae loans, FHA, and VA financial loans ought to be constant during the upcoming economic downturn.

Spreads are finding vast once again

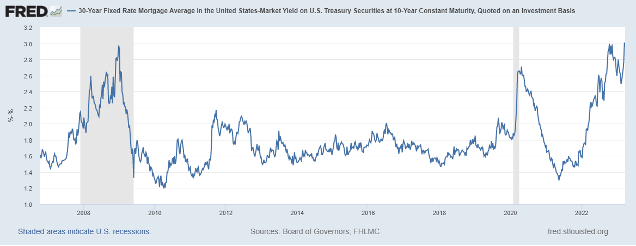

What has happened lately with the banking crisis is that the mortgage-backed securities market place has gotten much more stressed, so rates are greater than they should really be as the spreads concerning the 10-12 months yield and mortgage fees have widened once more.

As you can see beneath, the spreads acquired significantly broader throughout the fantastic financial disaster and COVID-19 recessionary durations. There is generally a 1.60%- 1.80% variation in between the 10-12 months yield and 30-12 months home loan rate, but now we are at 3%.

The chart down below tracks the stress in the property finance loan-backed securities industry: the higher the distribute concerning the 10-year yield and 30-calendar year mortgage loan gets, the larger the line goes. This suggests the dance partners, while however dancing, are making some space among each other.

The Federal Reserve does not care about the U.S. housing market. The Fed is complaining home finance loan prices are returning to 6% and men and women buying households could possibly make their job harder. The Fed will hurry to help save a financial institution, but will not whisper a phrase for an full housing current market to improve spreads.

So, the danger here is that when we have a work-reduction economic downturn, spreads get even even worse, as the Federal Reserve does not care. I would ordinarily imagine the Fed might assist the economy, but with this Federal Reserve, you hardly ever know what they will and won’t do. I talked about this Wednesday on CNBC.

We want to be mindful of this when the economic downturn hits. The housing current market might not get any support, even though we are acquiring closer to the one-year simply call when I put the housing sector in a recession on June 16, 2022.

Home owner stability sheets glance awesome this time all-around

As I explained earlier mentioned, credit finding tighter in relationship to desire is not a matter mainly because we didn’t have a huge credit history growth like that from 2002-2005 to then have a bust from 2005-2008 thanks to credit rating finding tighter.

The home loan industry can get stressed simply because the spreads can get broader, which means prices can be bigger than at standard periods. Nonetheless, we are not heading to see the credit score availability collapse in the exact same way we did in 2008.

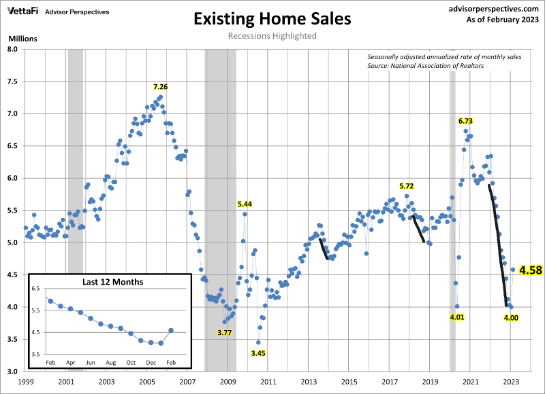

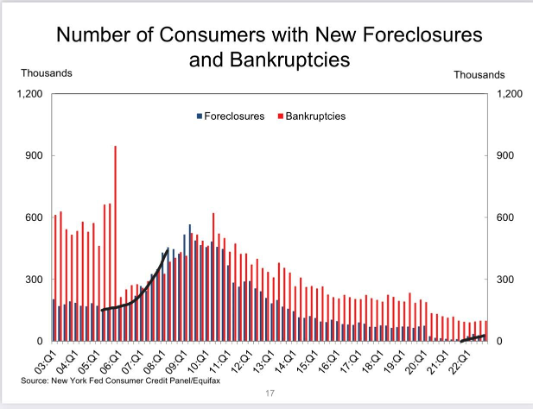

The most major difference involving 2008 and the very last 13 years following the certified house loan legislation were executed is that we do not see a surge in housing credit rating strain ahead of a job-reduction recession. If there is one particular chart I would exhibit every single working day, it is the 1 beneath: housing credit stress was effortless to place yrs just before the work-loss economic downturn happened. Right now it’s much much easier to see that we do not have related credit rating worry with house owners.

Simply because the U.S. has no more exotic loan credit card debt buildings, we do not have massive-scale risk tied to homeowners and banking institutions. Over time, the foreclosures knowledge should get nearer to pre-COVID-19 stages, but almost nothing like the credit stress we saw from 2003-2008.

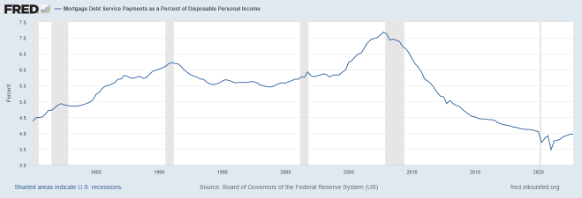

Homeowner financial information appears to be brilliant fastened debt cost, mounting wages, and money flow appear superior and far better in excess of time. As you can see under, mortgage personal debt service payments as a per cent of disposable individual earnings glance superb, a lot far better than in 2008.

This implies the hard cash circulation seems to be excellent! Do you want to know why people aren’t giving up households? A U.S. household with a 30-yr fixed mortgage is the most effective hedge on planet earth. As inflation arrives down, homeowners’ money move will get greater. During inflationary intervals, your wages develop more rapidly, but as a property owner, your debt costs remain the same.

As opposed to 2008, we really do not have a major threat of financial loans recasting with payments that the house owner cannot afford to pay for even if they ended up even now doing work. We will see a rise in 30-working day delinquencies, and more than 9-12 months, we will see a foreclosure approach perform. Nevertheless, in terms of scale, nothing at all like what we noticed in 2008.

Ideally, this gives you three unique credit normally takes on the credit issue when we go into recession.

Credit score tightening regarding most loans getting done currently isn’t a considerable danger because federal government companies again most financial loans completed in the U.S. On the other hand, the house loan-backed securities industry can keep stressed longer than most people today envision when the next economic downturn transpires.

We don’t have a rise in foreclosures as we did from 2005-2008 just before the occupation-reduction economic downturn. Nonetheless, we do have conventional danger, indicating that late-cycle homebuyers with little down payments can be a upcoming foreclosure danger if they eliminate their work opportunities.

So, we have a diverse financial backdrop now than in 2008 and 2020. Both recessions were being very various from every other, but this gives you an plan of some of the sizeable dynamics all around housing credit, financial debt and chance each time we go into the next economic downturn.

As constantly, we will take the information 1 day, week, and thirty day period at a time and wander this path alongside one another.