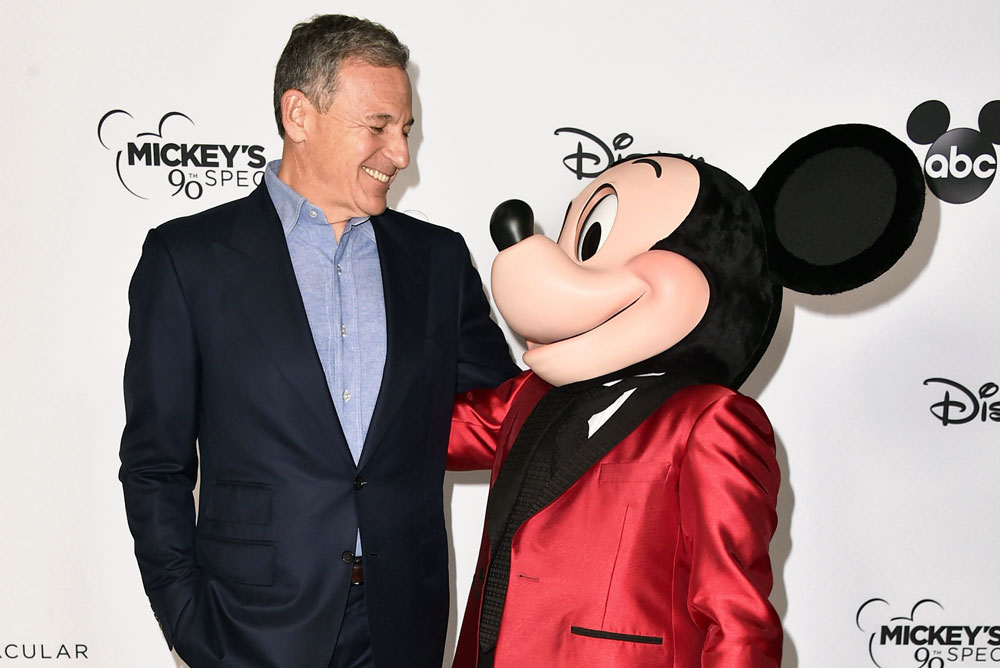

Disney’s first 2023 earnings call was jam-packed with news about restructuring, cost-cutting, and the future of streaming services. Unsurprising, since those are topics CEO Bob Iger signaled he’d address upon returning. However, he also expressed optimism about Walt Disney World and Disneyland, briefly outlining expansion ideas.

This also isn’t a surprise, as the Parks & Resorts–more specifically, Walt Disney World, Disneyland, and Disney Cruise Line–were once again a bright spot for Disney. The Disney Parks, Experiences and Products (DPEP or Parks & Resorts) segment saw a 21% increase in revenue to $8.7 billion during the most recent quarter, as compared to $7.2 billion in the prior-year quarter, and segment operating income increased 25% to $3.1 billion.

Removing consumer products from that total, the domestic and international parks accounted for over $7 billion in revenue, up 27%, and over $2 billion in income. Narrowing that further to just the domestic parks and the numbers are roughly the same: $6 billion in revenue and (still) over $2 billion in income. That means Walt Disney World, Disneyland, and DCL are doing the heavy lifting for the segment.

It’s thus unsurprising that Iger chose to conclude the call on a positive note for Walt Disney World and Disneyland fans, addressing the untapped potential of the parks. Even though we added this as a late update to our original earnings call post, we felt it was worth revisiting for those who missed it–and to add new details and greater context.

While discussing the future of Disney’s Parks & Resorts, Iger stated that he’s “very, very bullish.” Exciting sentiment, until followed up with: “Demand for the parks is extraordinary now. We can lean into the demand easily by letting more people in, and by more aggressively pricing.” Suddenly, not so exciting. More of the Chapek approach of continuously milking the cash cow. But wait, there’s more.

Iger continued: “We don’t think either would be smart. If we let more people in it’s going to reduce the guest experience, and that is certainly not what we want. In fact, if you look at our results this past holiday season, we actually reduced capacity, improved the guest experience, and were able to maintain profitability.”

This follows an earlier statement during the call from CFO Christine McCarthy that the company deliberately reduced capacity during the holiday season by 20% as compared to 2019. Those of you who visited Walt Disney World or Disneyland and encountered heavy crowds may not believe this–as it was still very busy–but both the wait time data and our on-the-ground experience on both coasts back it up. An interesting aside, but that’s not really the point of this post.

“Lastly, we have learned that when we invest in increasing capacity, with Star Wars: Galaxy’s Edge being a good example of that and Pandora a great example of that, we can grow our business,” Iger continued after further discussing how Disney would continue to manage the capacity they have. (Not good news for Annual Passholders who hate the reservation system, but we’ve said time and time again that reservations for APs are not going anywhere anytime soon–if ever.)

Iger indicated that if you look at the results when Pandora – The World of Avatar was built in Disney’s Animal Kingdom, the year-to-year growth numbers in terms of the number of people who visited were “stunning.” He went on to infer that Disney is going to bring Avatar to Disneyland for the same reason, and that he was investigating other such opportunities. “I talked to Josh D’Amaro about that this morning. Carefully look at all the great franchises of the company, and see where we can invest in them in the parks to increase capacity, while preserving guest satisfaction.”

This conclusion to the call is the key, and there’s a lot to unpack, so let’s get started. First, Pandora – The World of Avatar is worth looking at as a case study. Across the board, Walt Disney World attendance increased almost every single year from 2007 to 2019, so it wasn’t just growth at DAK.

With that said, Animal Kingdom far outperformed in percentage terms, jumping from 9.5 million to 14 million–with almost all of that coming post-Pandora. If you look at the spike in the two years after that land opened, it’s really remarkable. That one land essentially turned around Animal Kingdom. It didn’t just go from a half day to full day park–it went from one people weren’t visiting at all to a priority.

Disney’s Hollywood Studios was on a similar course after the opening of Toy Story Land. If what we witnessed on the ground in the first 2.5 months of 2020 was any indication, the impact of Star Wars: Galaxy’s Edge (or more specifically, Star Wars: Rise of the Resistance) would have been similar. Of course, that didn’t continue to play out as planned, and DHS is still hobbled by reduced capacity as compared to pre-closure. The point is that high-profile park expansions are major drivers of attendance.

What qualifies as an expansion is nebulous. In the cases of the Avatar and Star Wars lands, technically something was being replaced–it wasn’t a “pure” expansion. However, those things (Camp Minnie-Mickey and the Backlot) were underutilized capacity that had almost no drawing power. There’s a reason why the Streets of America was the perfect spot for the Osborne Lights–and why relocating them would’ve proven nearly impossible–the out of the way area didn’t have anything to draw crowds.

This is different from reimagining or even building a single new attraction. Mission Breakout is widely viewed as a surprising success story for Disney California Adventure, and even we can concede that the result is a fun and better-than-expected attraction. But it took a popular attraction and made it more popular. The impact on park attendance was not nearly as pronounced.

When looking through theme park visitors statistics, the same can probably be said for Frozen Ever After, Star Tours: The Adventures Continue, and other additions that weren’t expansions. (It’s impossible to assess anything added since 2020 as the data is either skewed due to capacity reductions or not yet available. It’s my belief that the EPCOT overhaul has moved the needle for that park, but I don’t have corroborating stats.)

While Iger is the one who articulated this perspective on the first earnings call of 2023, it’s hardly a new idea. For one thing, Iger was at the helm when Pandora – The World of Avatar, Toy Story Land, and Star Wars: Galaxy’s Edge were greenlit and opened. He would’ve seen the visitor data for at least the first two projects, and already had that expansion approach vindicated.

Years before that, he established the blueprint for such a strategy with the overhaul and expansion of Disney California Adventure, arguably the biggest success story of all. That 2012 transformation, along with New Fantasyland, was likely the catalyst for the most recent wave of development that is now wrapping up.

Although our focus is Walt Disney World, similar announcements came under Iger for the other parks. Hong Kong Disneyland is already double the park it was when it opened, with Arendelle: The World of Frozen being another blockbuster expansion initiated under Iger. Same goes for the Walt Disney Studios Park in Paris, which totally sucked until expansion plans were set in motion under Iger. It still sucks, but it’s heading in the right direction and will have its own Arendelle in another couple years.

Then there’s what Parks Chairman Josh D’Amaro teased at the most recent D23 Expo. He was joined on-stage by Imagineer Chris Beatty and Chief Creative Officer of Walt Disney Animation Studios Jennifer Lee to discuss early concept explorations. They started with Dinoland USA at Animal Kingdom, and potential expansion opportunities including a Zootopia Metropolis and Moana Mini-Land.

Then they turned to Magic Kingdom, where it was apparent this was much more ‘blue sky’ in nature. That presentation looked at Magic Kingdom Expansion Possibilities “Beyond Big Thunder” and showcased possible Coco, Encanto & Villains lands. While there was initial excitement among fans, that quickly soured. The positive sentiment gave way for skepticism about these possible plans, especially in light of Disney’s not-so-stellar track record in building things that were “firmly” confirmed at past D23 Expos.

Back in our D23 post-mortem, I presented my case for being optimistic about the panel and future of Parks & Resorts, and reading between the lines despite all of this: “Walt Disney World continues to outperform, and investors have begun to take notice of its success. This coupled with Wall Street souring on streaming (at least a bit) means Disney may finally start to bet bigger on its theme park business. Given that, a big slate of announcements at the 2022 D23 Expo was a possibility.”

“From my perspective, that’s almost certainly why we saw the early expansion plans for Animal Kingdom and Magic Kingdom. A realization by the company that Wall Street is increasingly skeptical of the streaming business, but all-in on theme parks. Given that this is a relatively recent development, the company hasn’t had a chance to finalize plans. Still, they want us–and more importantly to them, Wall Street–to know that big investments are on the horizon.”

If you go back and read that article today or think back to the D23 Expo in light of the surrounding circumstances at the time and consider what has happened since, I think that’s even more plausible. Wall Street was already souring on streaming subscriber growth, but that Parks & Resorts panel was before the quarterly earnings call that revealed $1.5 billion in losses on streaming. (As a reminder, financials are reported a couple of months after their quarters conclude–meaning that the D23 Expo fell within that particularly poor quarter.)

Those results proved to be Chapek’s undoing, setting in motion the return of Bob Iger, the dismantling of Disney Media and Entertainment Distribution, and a promise to be more responsible with runaway spending on streaming.

Equally as significant, this came before investors became vocal about the performance of Parks & Resorts. Although he’s called off the proxy battle, one of the cornerstones of Nelson Peltz’s “Restore the Magic” campaign was that the domestic theme parks were “over-earning” to subsidize losses elsewhere. He contended that margins had been pushed too far, too fast in a manner that was unsustainable. Peltz wanted to see more responsible growth at Disney’s domestic parks.

He’s not alone. If you’ve read or listened to analysts following the most recent two earnings calls (again occurring after that D23 Expo), “what about parks?” is a constant refrain. The sentiment is that Walt Disney World and Disneyland are doing really well, proving surprisingly resilient, and one of the company’s few bright spots. The message Wall Street is sending is that investment in theme parks is smart and safe, and the appropriate course of action.

Honestly, this is frustrating. Disney already learned this exact lesson after the Great Recession–hence the last development boom. The whole reason Disney focused on streaming subscriber growth was because that was Wall Street’s key metric for media company success at the time. Now they’re changing the ‘rules’ mid-game and acting like they just discovered the popularity of theme parks. As if all of the colossal expansion plans of the last decade occurred by luck or accident. But I digress.

The good news is that everyone seems to be on the same page. Wall Street is more bullish about Disney’s theme parks than streaming services. Bob Iger and Josh D’Amaro want to build capacity-expanding additions to the parks. Walt Disney World and Disneyland fans are obviously on board. Heck, I think even Bob Chapek was in favor of this…and we don’t exactly throw around praise for that umbrella aficionado here!

If everyone is on the same page and expansion is on the horizon for Walt Disney World and Disneyland, why haven’t we heard official announcements? Is it just a matter of Imagineering putting the finishing touches on plans and concept art? This brings us to the bad news…

Earlier in the earnings call, Iger discussed the company’s restructuring and cost-cutting initiatives. To that point, Disney will be cutting $5.5 billion in costs, made up of $3 billion from reductions in content and the remaining $2.5 billion from non-content cuts. As part of that, the company is reducing its workforce by 7,000.

There are a couple main reasons for this. The first is the debt Disney took on with the 20th Century Fox acquisition and at the start of the pandemic. The second is streaming losses, which increased for the quarter by $0.5 billion to $1.1 billion. This is the third consecutive quarter that streaming has racked up over $1 billion in losses.

Note that this is not a failure of Disney+ or due to unpopularity (quite the opposite is true). Streaming losing money its first several years was always the plan. Disney+ launched with a ‘growth at all costs’ user acquisition strategy to capture market share, which was kicked into higher gear by Chapek until Wall Street changed the metric of success. As before, Disney+ is on a path to profitability, but not until late 2024.

As a result of this, CFO Christine McCarthy indicated that fiscal 2023 capital expenditures at Parks & Resorts will total proximally $6 billion, which is lower than the prior guidance of $6.7 billion. Interestingly, this is not primarily due to decreases in CapEx at the domestic parks, but rather, due to “timing shifts.”

It’s difficult to determine where Disney Parks & Resorts could save $700 million as a result of “timing shifts.” My best guesses are delays in Arendelle at Walt Disney Studios Park, Polynesian DVC Tower, and whatever the heck is going on with Disney Cruise Line and Lighthouse Point.

Everything else is either too far along or necessary (knock on wood). It’s hard to see the EPCOT overhaul paused at this point, but then again, I would’ve said the same thing in Spring 2020. Delaying Tiana’s Bayou Adventure seems equally unlikely, as does postponing other projects nearing completion. The savings could also be on CapEx projects that were slated to begin this fiscal year, but now will not.

Ultimately, it might seem difficult to reconcile Bob Iger’s bullishness on big expansion at Walt Disney World and Disneyland with the aforementioned near-term cost-cutting. As was the case after the odd panel at the D23 Expo, we totally understand fan skepticism, pessimism, and downright dismissiveness. Actions speak louder than words, and it might be hard to take at face value Bob Iger’s claim that he’s “very, very bullish” on building new capacity when he’s cutting budgets. That’s fair.

However, it’s quite easy to reconcile. Just look at the timeline for Pandora – World of Avatar, or any of the other aforementioned new lands. Pandora is the most extreme example, being announced years before construction ever began. Other additions have had similarly slow turnaround times. I probably don’t need to belabor this point…you’ve all seen how long it took Disney to build TRON Lightcycle Run. My guess is that the next development cycle will play out in this same fashion. Suffice to say, whatever is announced this year won’t impact CapEx numbers until 2024 or 2025.

As for the timing of announcements, they could occur whenever, but one entry on the calendar stands out to me: Destination D23 will be held September 8–10, 2023 in Contemporary Resort at Walt Disney World. This event celebrates Disney100, and would be the perfect opportunity for big news. And not just because of its location or the fact that it’s the only major event scheduled.

Timing-wise, Destination D23 is near the end of the current fiscal year, and start of the next one–the year by which Disney+ is (supposedly) going to attain profitability. It’s also near the anniversary of Walt Disney World and EPCOT’s opening (October 1), which isn’t particularly meaningful on its own given the lack of milestone, but would be a logical date for the Florida parks to start celebrating 100 Years of Wonder.

Given all of that, my guess is that we get a slow tease of news later this summer about the new nighttime spectacular at EPCOT and that Walt Disney World will celebrate the company’s 100th Anniversary starting this fall. Then, during Destination D23, specifics are shared (drones! decorations! dreamlights! merchandise! more!) about Disney100 at Walt Disney World, which will serve as a bridge to the opening of Tiana’s Bayou Adventure (expect to also see video of that–hopefully of impressive new Audio Animatronics that put some criticism to rest).

Most significantly, I’d expect an official announcement of Animal Kingdom expansion, and possibly another vague tease of something coming Beyond Big Thunder in Magic Kingdom. Disneyland is more of a wildcard, with Fantasyland or Tomorrowland expansion being possibilities (as well as the previously announced Marvel E-Ticket and Avatar “Experience”). Don’t get too excited yet, as the timeline for the first new lands opening is likely 4+ years out, but I firmly believe that they’re coming to both ‘kingdoms’ in Walt Disney World.

Planning a Walt Disney World trip? Learn about hotels on our Walt Disney World Hotels Reviews page. For where to eat, read our Walt Disney World Restaurant Reviews. To save money on tickets or determine which type to buy, read our Tips for Saving Money on Walt Disney World Tickets post. Our What to Pack for Disney Trips post takes a unique look at clever items to take. For what to do and when to do it, our Walt Disney World Ride Guides will help. For comprehensive advice, the best place to start is our Walt Disney World Trip Planning Guide for everything you need to know!

YOUR THOUGHTS

What is your reaction to Bob Iger saying he’s “very, very bullish” about park expansion at Walt Disney World and Disneyland? Think this can be reconciled with the near-term cost-cutting, or would you rather not build anticipation for something several years out, or that may never come to fruition? What potential plans have you most and least excited? Anything you’re hoping does not end up coming to fruition? Do you agree or disagree with our assessments? Any questions we can help you answer? Hearing your feedback–even when you disagree with us–is both interesting to us and helpful to other readers, so please share your thoughts below in the comments!