What is happening with homebuilders and the new residence profits sector as we head into the spring housing current market? We have experienced some conflicting info factors lately. On the a person hand, cancelation rates have been climbing. On the other hand, property finance loan costs have absent down much more than 1% because Oct. 20, 2022.

The builders’ inventory prices have completed nicely as home finance loan fees have fallen, and this illustrates the simplicity of the homebuilders’ posture: their tale is really about home finance loan costs and going items.

The builders sell houses as if they have been a commodity: they create and sell to make the most income achievable and shift on. The builders really don’t like to see provide of present households increasing for panic that their consumers may terminate on them. The expansion of offer usually means need is having weaker, which will require builders to give more incentives to purchasers.

Now, they want to guarantee that the buyers who are nonetheless experienced are however there to near the deal when properties are prepared to move into. This will make them a great deal additional successful sellers than existing home owners, who will need to obtain an additional household as soon as they market. The builders do not have that trouble — they just want to get households off their textbooks as shortly as possible.

So, as the 10-12 months yield has fallen along with home finance loan rates, buyers are anticipating the builders can sell much more of their goods once they are prepared to be moved into. This is the biggest reason why homebuilder stocks have carried out so well not too long ago.

How quite a few new properties are out there?

The hottest Census report demonstrates that 71,000 new properties are concluded and fantastic to go, which is near to the historical average for new houses done of 80,000 to 100,000.

Here’s the breakout:

- 71,000 new houses have been concluded: 1.4 months of provide.

- 291,000 properties are even now below design: 5.7 months of offer

- 99.000 homes have nevertheless to be started out: 1.9 months of source

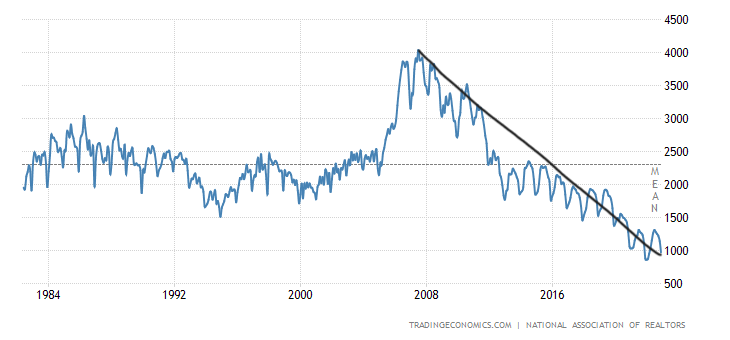

As you can see, this is not a whole lot of homes when you contemplate the inhabitants of the U.S. The builders essentially lucked out here since back in 2007, we experienced above 4 million energetic listings of current home, which are usually more cost-effective than similar new properties. Centered on the past NAR present home income report, we only have 970,000 energetic listings — this is the next-most affordable degree ever in current record going into January.

New dwelling revenue are even now historically minimal

From Census: New Household Income Revenue of new solitary-family homes in December 2022 ended up at a seasonally modified once-a-year level of 616,000, in accordance to estimates produced jointly right now by the U.S. Census Bureau and the Office of Housing and Urban Enhancement. This is 2.3 percent (±18.5 p.c)* earlier mentioned the revised November fee of 602,000, but is 26.6 percent (±13.2 %) under the December 2021 estimate of 839,000. An estimated 644,000 new residences have been sold in 2022. This is 16.4 % (±3.8 p.c) down below the 2021 determine of 771,000.

As you can see beneath, new dwelling gross sales have not absent everywhere for some time now, and the past months’ information tends to get revised reduce. The headline variety doesn’t account for cancelation premiums. So, in truth, we wont see motion below right up until property finance loan fees get very low enough for the cancelation percentage to drop.

For homebuilders, the month-to-month supply of new residences is still way too high

From Census: For Sale Inventory and Months’ Offer, The seasonally modified estimate of new residences for sale at the finish of December was 461,000. This signifies a provide of 9. months at the present-day profits level.

The month to month offer for new residences is however as well significant this is why housing permits are falling significantly these days. The builders under no circumstances want to oversupply a market place due to the fact that would damage their business enterprise design.

My rule of thumb for anticipating builder behavior is based mostly on the 3-month source average. This has nothing to do with the existing house sales sector this month to month offer info only applies to the new household profits industry, and the existing 9 months is as well significant.

- When supply is 4.3 months and down below, this is an excellent market for builders.

- When offer is 4.4 to 6.4 months, this is an Ok market for the builders. They will develop as long as new house sales are escalating.

- The builders will pull back on design when the source is 6.5 months and earlier mentioned.

I do have an understanding of why selected individuals, primarily 2008 housing crash persons, are confused about why the homebuilders’ shares have rallied so tricky a short while ago. But due to the fact Oct. 20, property finance loan rates have been heading reduce, which suggests bond yields have headed lower. This usually indicates income goes into the builder stocks — they’re not pricey stocks and now have a a lot greater harmony sheet, like U.S. homeowner households, as seen in the chart below.

On the economic aspect of the equation, we even now have a whole lot of function to do listed here. The builders have to get the job done off the backlog of households, but in its place of 3%-4% mortgage prices, they are dealing with 6% furthermore home finance loan charges, which implies they have to deliver several incentives to make guaranteed people households offer. Considering the fact that home finance loan fees have fallen, the homebuilder self-confidence index has stopped falling, and we have experienced an uptick just lately. The place I am producing here is that it’s about fees now.

As long as bond yields really do not reverse class and property finance loan premiums really don’t go larger, the story should stay the exact. Nonetheless, if house loan rates can truly get down towards 5%, the homebuilders will be a lot more enthusiastic, as this was the stage past yr that received extra consumers into their marketplace. Plus, they could not want to price reduction so a lot by then.

Having said that, until finally that bridge is crossed, the builders will grind this out, finish up their backlog of residences and consider to near as lots of promotions as attainable.