Property finance loan fees are down once again this 7 days, which signifies points are seeking up for homebuyers.

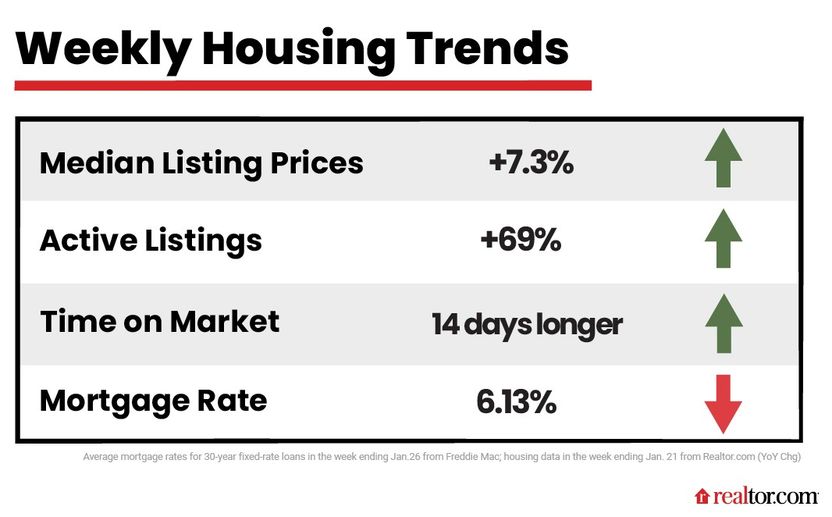

The normal level for a 30-year set-amount property finance loan ticked down 2 basis points to 6.13%, according to Freddie Mac, continuing a pattern of prices seesawing decreased considering the fact that topping 7% in the drop. In fact, mortgage loan charges are at their cheapest levels because mid-September 2022.

However, whilst lower borrowing fees are a boon for homebuyers, handful of look to be pouncing on this possibility as they could have a year or two earlier.

“As we shift into the new calendar year, housing industry information carries on to counsel that potential buyers are comparatively sluggish as the whole amount of residences for sale climbs increased and residences shell out extra times on marketplace,” famous Realtor.com® Main Economist Danielle Hale in her investigation for the 7 days ending Jan. 21. “After unprecedented urgency to locate and shut on a house in 2021 and 2022, purchasers in today’s housing marketplace are evidently operating beneath a diverse established of anticipations and a significantly better measure of persistence.”

We’ll search at why homebuyers are not relocating on this property finance loan charge reprieve with more gusto—and what it may possibly imply for homebuying this year—in this installment of “How’s the Housing Market place This 7 days?”

Why home finance loan fees are slipping

The further home loan rates dip, the fewer of a fluke these decreased premiums show up to be. And for this, we can thank easing inflation.

“This is the first time following approximately two years that the inflation fee is at last decreased than it was the earlier 12 months,” describes Nadia Evangelou, senior economist and director of authentic estate investigation at the National Affiliation of Realtors®.

As a end result, she predicts, “Mortgage prices may drop even even more in the adhering to months as traders hope the Federal Reserve to just take a lesser fee hike in February.”

Decrease inflation rates may well spell excellent news not just for mortgage loan rates, but also for home price ranges (more on that upcoming).

An period of more ‘normal’ price gains?

For the week ending Jan. 21, listing charges were 7.3% better than this exact week previous calendar year. Whilst still up, this would be viewed as a far more “normal” price get than the frothiness of the COVID-19 pandemic period, when charges had been increasing week following 7 days by double digits.

In reality, December 2022, with its median listing price of $400,000, marked a noteworthy milestone: It’s the 1st thirty day period in a yr when 12 months-more than-calendar year rates had been larger by only single digits.

Properties are having more time to market

Whilst today’s slower price tag gains is good information for homebuyers, so much, they are not experience all that encouraged to snap up the merchandise.

For the 7 days ending Jan. 21, households lingered on the industry 14 days for a longer time than this identical time final 12 months, marking 6 comprehensive months of properties using for a longer time to offer than a 12 months before.

This calmer tempo of market place activity is a relief to home hunters, who now have additional time to make selections without the need of the pressure to beat out rivals amid the bidding wars that dominated a 12 months back. This is specially real for very first-timers, Hale notes, who “are navigating what can be a challenging course of action even for experienced purchasers.”

On the flip facet, Hale provides, “homeowners looking to provide in 2023 will want to be aware of the slower market place speed to set their expectations appropriately.”

Your house may possibly not offer in the initial hour it hits the current market, in other words—and which is Ok.

Home sellers are being careful

As for prospective house sellers who may well be imagining about listing their households? They, way too, appear to be to be biding their time.

For the week ending Jan. 21, 5% fewer properties ended up stated for sale than the identical 7 days a yr before, marking the 29th straight week of declines. That mentioned, homebuyers have a lot to shop for with energetic listings up 69%.

By February, Hale thinks, more homeowners may well be inclined to market their households, which would be a welcome improvement for the marketplace.

As for what to anticipate, Evangelou thinks this spring’s homebuying year will perk up, though not really as substantially as the past few of decades when mortgage loan rates strike file lows correct although folks itching to go hit pandemic highs.

“Generally, property sales exercise will increase by 33% in March when compared to February,” claims Evangelou. “However, in the previous couple of yrs, activity was even busier thanks to minimal mortgage loan fees. Even however charges ended up soaring very last March, lots of purchasers were being hurrying to benefit from the 4% charges during that time.”

This March will be diverse.

“Given very low affordability and inventory, action might not ramp up so rapid in the spring time this 12 months, but it will certainly be busier than it presently is,” Evangelou claims. “Meanwhile, a more robust housing marketplace could assistance the U.S. economic system to skirt a economic downturn.”

In other words and phrases, a powerful economy and a powerful housing market show up to go hand in hand, and could quite nicely be on the horizon.